The price of groceries or a gallon of gas aren’t the only things affected by inflation. Many figures in the tax code are also indexed to inflation and receive adjustments each year. With inflation the highest it has been in nearly 40 years, we have seen many contribution limits increased substantially, especially those for retirement plans.

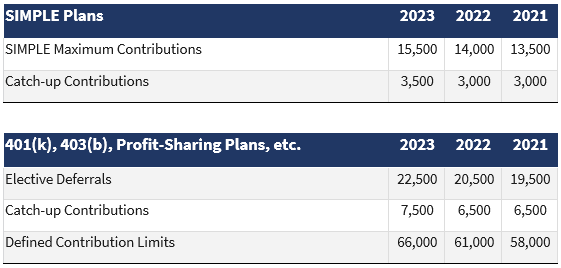

In 2023, employees can contribute up to $22,500 in 401(k)’s, 403(b)s and most 457 plans. If you are over age 50 you can contribute an additional $7,500 in catch up contributions, for a total of $30,000 ($2,500 per month).

For Simple IRA’s the employee contribution limit is $15,500 and for those over age 50 they can contribute an additional $3,500, for a total of $19,000 ($1,583 per month).

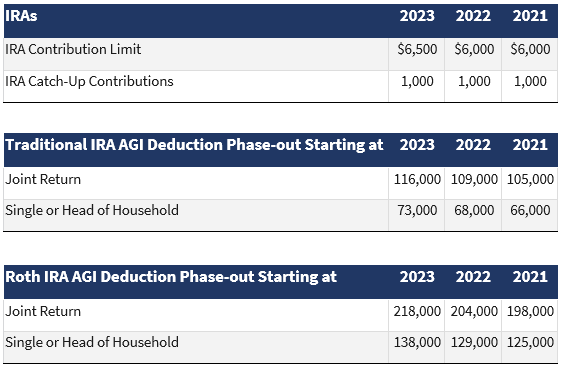

For IRAs and Roth IRAs, the 2023 contribution limit is $6,500, plus if you are over 50 you can contribute a catch-up amount. Interestingly, this catch-up amount is not indexed for inflation and therefore remains at $1,000, allowing for a maximum contribution of $7,500.

The income limitations for making Roth and deductible IRA contributions have also all increased for 2023. These limitations vary depending upon your filing status and if you are covered by a retirement plan at work, so we encourage you to talk to us or consult your tax advisor prior to making any contributions.

With such widespread adjustments to that tax code, we encourage you to reach out to us to see how these changes may impact your situation.