Investors continue to ride a roller coaster of emotions. In June, stock prices appeared bottomed and enjoyed a furious two-month rally driven by hopes of an imminent central bank “pivot” from increasing rates to cutting rates. The hope was for an early retreat by inflation and a resulting change in interest rate policy that would return us to the glory days of 2021 when rates were zero, money was printed and spent with abandon, and every idea was going to be the next “disruptive” market leader.

But that was not to be. By late September, the globe’s major stock indices retraced their summer gains and made new lows. Surprisingly, when we flipped the calendar to October (a month with a well- earned reputation for difficult markets), stock prices soared. Although there were some down days, the month actually finished with some of the best gains for the Dow since the mid -1970s. Unfortunately, the start of November has again brought volatility with a stark dose of reality delivered by Jerome Powell in his press conference on November 2. In that press event, the Chairman made clear that while the Fed might slow the pace of rate hikes, which would likely be offset by a higher final rate that would likely be in place for longer. The Dow swung 800 points in a matter of two hours and finished down sharply, once again frustrating the bulls. With continued upward pressure on interest rates, this is to be expected. The math of valuing any asset, be it a stock or bond or real property, dictates that higher rates result in lower prices. That simple fact is why there is so much focus on what the Fed and other central banks should do or might do. The reality is that until the Fed pauses in its tightening campaign, it will be very difficult for stock or bond prices to meaningfully and sustainably advance. That pause, will, in turn, require signs that inflation is not just peaking (which it likely has) but that it is actually in retreat. Unfortunately, that evidence isn’t too be seen right now.

That fact didn’t deter the bulls, however. A week after the Powell press conference, a modestly better than expected CPI report led a surge in stock prices. The rollercoaster ride continues.

Third Quarter Overview

After a very difficult first half of the year, equity markets rebounded in July and August on investor hopes of an easing in inflation and a Fed pivot or pause. The reprieve was short-lived however, as stocks tumbled to fresh lows in late September amid further aggressive central bank rate hikes and statements of further tightening to come. The S&P 500 dropped 4.88% for the quarter and is down 23.87% for the year. Interestingly, nine trading days have accounted for the entire decline in the S&P this year. Developed international markets (MSCI EAFE Index) fell 9.36% for the quarter and 27.09% YTD. Emerging Market stocks (MSCI Emerging Markets Index) dropped 11.57% for the quarter, and down 27.16% YTD. Foreign equity market returns for U.S. dollar-based investors were worsened by the sharp appreciation of the dollar. The U.S. Dollar Index was up 7.1% for the quarter and a stunning 17.3% on the year, hitting a 20-year high. These dollar gains translate into roughly comparable losses for U.S. dollar-based investors investing in international equity markets. If the dollar doesn’t pause or weaken soon, we would suspect that the next financial “accident” will involve a foreign government or corporation laid low by the currency markets.

11.57% for the quarter, and down 27.16% YTD. Foreign equity market returns for U.S. dollar-based investors were worsened by the sharp appreciation of the dollar. The U.S. Dollar Index was up 7.1% for the quarter and a stunning 17.3% on the year, hitting a 20-year high. These dollar gains translate into roughly comparable losses for U.S. dollar-based investors investing in international equity markets. If the dollar doesn’t pause or weaken soon, we would suspect that the next financial “accident” will involve a foreign government or corporation laid low by the currency markets.

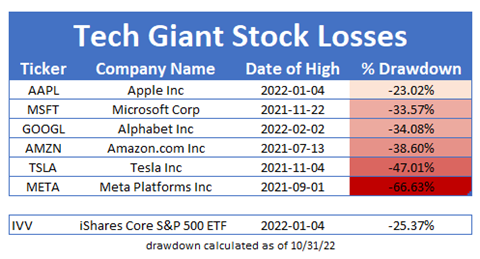

For equities, the damage has been wide-spread and the tech darlings of 2021 haven’t been immune. As the table reflects, the losses in aggregate value for tech giant stocks are really staggering.

Bonds continued to suffer in the quarter. Core investment-grade bonds didn’t avoid the Q3 carnage. The 10-year Treasury yield hit a decade high of 3.97%, causing the Bloomberg U.S. Aggregate Bond Index (the “Agg”) to drop 4.75%. This puts the “safe-haven” Agg down an incredible 14.61% for the year to date. While credit exposure (other than junk bonds) and short maturities mitigated the damage, the fact is that this remains an historically awful year for fixed income investing.

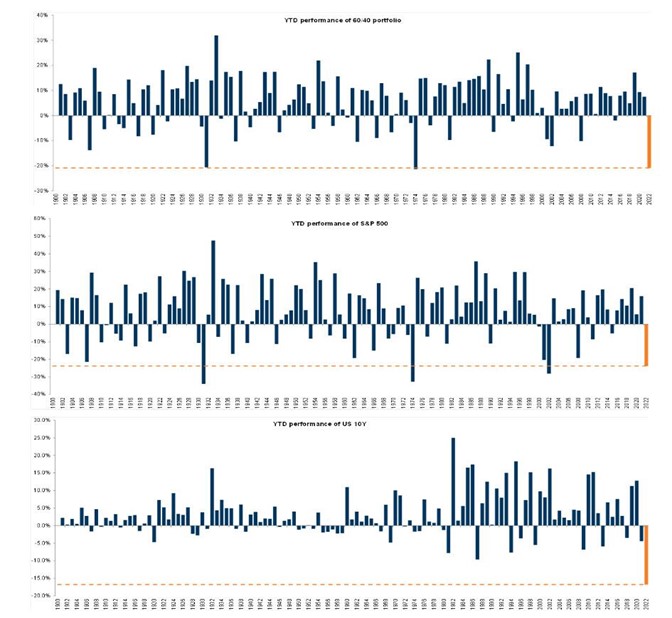

The historic aspect of these drawdowns is illustrated in the charts going back to 1900 on the following page. For the US 60/40 stock bond portfolio, long viewed as the benchmark for retirement plans, only 1974 produced a worse return in the first nine months of the year. Of note, 1974 was also a year that saw an energy related inflation spike. For the S&P 500, this is the fourth worst year on record with only 1931 (the Great Depression), 1974 (inflation shock) and 2002 (bursting of the dot com bubble) down more. And for bonds, as measured by the 10-year US Treasury, 2022’s 17% decline is hands down the worst year ever. In 1987, the previous worst year, bonds were down “just” 10%.

As we have worked to avoid the bond market carnage, we are pleased with the result for our alternative and income -oriented assets. Assuming reasonable levels of credit risk is key in venturing beyond traditional bonds, and we continue to see opportunities in these areas though we are mindful of recession risks as well.

The Outlook for the Fourth Quarter and 2023

In the spring, we noted that the equity market struggles could be compared to a play with two acts. The first act involved interest rates moving higher, which has in turn push down price earnings ratios. At the start of the year (it is hard to remember that the market made a new high on January 3, 2022), investors were willing to pay 22 times a dollar of S&P 500 earnings. The relentless move up in rates has pushed that PE ratio down to approximately 16 times as we write. We suspect that the bulk of margin adjustment is behind us.

The second act in the drama involves earnings. The question now before us, is what will earnings be? Inflation pressures are beginning to take a toll on corporate profit margins. More importantly, companies are beginning to report more fundamental challenges to their business. As examples, you can look to the big box retailers (i.e., Wal Mart and Target) stuck with merchandise that consumers suddenly don’t want or need. On the manufacturing side, Nike has reported similar challenges. And in late September, FedEx reported a sharp drop off in business. Their earnings warning was interesting because it didn’t cite or lament higher costs but instead focused on the sharp drop in demand. We view FedEx as something of a bellwether and canary in the economic coal mine so their report is concerning. In the first week of October, a major semiconductor manufacturer (AMD) pre-announced disappointing result.

With those announcements causing some dread, actual results for the third quarter were weak but not disastrous. Managements are cautious and guidance is being reduced as firms in all industries are dealing with higher costs due to inflation and uncertain outlook for revenue. If the economy manages to avoid a recession, we would suspect that the earnings damage will be well contained. Over time, we are enormously confident that US companies can and will adapt to a changed landscape so we don’t fear the destination but the trip could be bumpy. Alternatively, if inflation remains stubbornly high, the Fed will be forced to raise rates higher and faster than the market anticipates. Those rates may also stay elevated for some time. In that case, we would imagine a more meaningful hit to earnings and further pressure on prices. To put numbers to the exercise, analysts saw the S&P producing nearly $240 per share of earnings. In a stable rate environment, if you value those results at the 22 times noted earlier, you expect a year end S&P of 5,280. If, instead, earnings decline to $220 per share and higher interest rates push the multiple to 16.5 times, the market would be fairly valued at roughly 3,600. By way of reference, the S&P 500 closed at 4,076 on Friday December 3. Please note that these figures don’t represent projections. Instead, they highlight the math challenge equities face that the Fed has to fight inflation rather than printing money.

As you can no doubt gather, we remain cautious because of what Jerome Powell told us in September. With the Fed’s preferred inflation measure (Core PCE) at 4.9% and Fed Funds at 3.25%, we think the Fed will raise rates another 1.5% to 1.75% before the year is out. The market has priced some of that path into prices. The Chairman doubled down on these sentiments November 2. If they get rates to that level and then pause, that will probably be the time to become for aggressive in adding to risk assets.

We humbly acknowledge the risks of forecasting economic developments. Because of these challenges, we remain more focused on fundamentals and individual client needs than on the unpredictable and the uncontrollable. But, ignoring the macro-economic realities can be as dangerous as pretending that we know with certainty what will happened in the future. Thus, we diversify and constantly challenge our thinking to imagine how things might unfold differently.

On the bullish side of the ledger, we are now in the best time of the calendar year for equity investors and lots of bad news has already been priced in. if the economy is weakening or building financial pressures are unleashed, the Fed and the world’s other Central banks will likely pause or even reverse course in the inflation fight. The prospect of this was what almost single handedly drove the 17% market rally between mid-June and mid-August. A prime example is the about face made by the Bank of England the last week of September as the pound and UK government bonds came under extreme pressure. While pledging to keep fighting inflation (which is in double digits in the UK) with higher rates, quantitative easing was resumed. If this strikes you as contradictory, you are correct. But in the world created by the fourteen years of excess stimulus, the choices available to most countries are not a contest between good and bad but between bad and worse.

Perhaps even more meaningful would be a resolution of the conflict in Ukraine. If a negotiated peace would be announced next week, asset prices would skyrocket. It doesn’t seem too outlandish to note that the conflict won’t go on forever. While we pray for a rapid and peaceful resolution, we need to also note that a cornered autocrat armed with a huge nuclear arsenal could take the conflict in a terrible direction. Even if there is a settlement, what will a wounded, weakened and isolated Russia look like? The bottom line is that this could become much worse or much better rapidly.

We could make similar observations about China and the Middle East. In China, the October Party Congress was noteworthy for its tone and the clear consolidation of power by Xi Jinping. Hopes for trade liberalization, or an end to the country’s zero Covid policy seems remote. In Iran, recent freedom protests offer some hope that one of the world’s most dangerous countries might see a change at the top. Even a quick study of the Middle East, however, suggests that what comes next isn’t always better.

With regard to fixed income, our observations about the outlook for rates suggest that caution remains in order for bonds. There can be no doubt that the selloff this year as made the risk return profile for bonds more symmetrical (i.e., more equivalent up and downside) risk. Thus, we will continue to look for opportunities to add to bonds particularly as we see the Fed’s work ending.

The best news of the year (not a real robust contest given how little good news there has been), is that as the Fed has raised rates and the market has anticipated further gains, rates on cash are finally rising. Yields on Treasury bills, which are the world’s safest and most liquid asset, now top 4%. After nearly 14 years when cash paid nothing, it is refreshing to be able to secure some reasonable yields while we await more hospitable asset prices.

Other Year End Topics

The older we get, the quicker time flies by. It is hard to believe that we are in the last quarter of 2022. But given the nature of the year, January 1 can’t get here soon enough. Between now and then, we will be focused not only on the markets but on year- end tax planning opportunities that come from a lousy market year. That includes tax loss harvesting, retirement plan funding and, for some people, considering the merits of Roth IRA conversions. We look forward to discussing these matters with you as well as your thoughts and concerns about this trying year.