It seems like only yesterday, or three months ago, that financial markets were in full-blown panic mode. The Trump administration announced painful and punitive tariffs for trading partners worldwide. Markets panicked as the tariff cure seemed worse than the trade deficit it was intended to cure. By April 9th, the administration relented and delayed the imposition of the most punitive tariffs seen in years. The 90-day pause was intended to provide time for negotiations with our most important trading partners.

The challenge is that negotiations are complex and take time. Before Liberation Day, history suggested that bilateral trade deals took 18 months to negotiate. The likelihood of negotiations succeeding with over 100 trading partners in 90 days was, and is, zero. While the administration has announced the framework of agreements with some of our partners (Britain, China, and Vietnam), other arrangements are proving more elusive (Japan, Canada, and the EU come to mind). The truth is that 10 countries ship more than 60% of our imports (Mexico, Canada, China, Germany, Japan, Switzerland, Ireland, Taiwan, South Korea, and Vietnam). If agreements were reached with these countries, tariffs on other nations wouldn’t be material to the long-term economic outlook.

We will await news on these matters in the coming weeks. Our sense in April was that the self-imposed pain of tariffs is something that could change on a dime. That is, in fact, what happened on April 9, and we expect to see more in the way of policy pivots during the summer.

While tariff news dominated investor attention, other profound news got less attention during the quarter. Geopolitics came to the fore in June as Israel and Iran exchanged bombardments during the “twelve-day” war. US involvement, in the form of B-2 and missile attacks on Iranian nuclear facilities, seemed to end the conflict. While oil prices initially soared on the outbreak of hostilities, they quickly fell as energy infrastructure was spared and the Strait of Hormuz remained open. We hope the world is a safer place today, but the Middle East has dominated geopolitics during our lifetimes. We worry about the “unknown unknowns” that Donald Rumsfeld memorably described.

The other big news of the quarter involved the passage of the One Big Beautiful Bill Act (OBBBA). We will discuss the bill and its key provisions in more detail later in our note, but the significance of extending the 2017 tax rates is vital for the economy and financial markets. Important is not the same as good, however. We are disappointed that more attention wasn’t paid to reducing our already massive Federal budget deficit. Running $2 trillion deficits for as far as the eye can see is reckless. Both parties are now officially on the record as not caring a bit about this issue. As our friends at Grant’s Interest Rate Observer noted, “whatever financial problems the future may hold, a bond shortage is unlikely to be one.”

Market reaction to these developments was historic. After tumbling 18.9% from its February high to its April 8 low, the S&P 500 posted its fastest-ever recovery (i.e., 89 days) to new all-time highs. This recovery was the biggest intra-quarter decline to be erased within the quarter since 1928.

This recovery also reversed some of the surprising results from the first quarter. Bonds lagged stocks badly, and the Fed seems disinclined to cut short-term interest rates. Foreign markets, which had a terrific first quarter, were up in the second quarter but trailed the US markets. Domestically, growth dominated value, and large stocks beat small stocks meaningfully. The US dollar suffered its worst six-month return since 1973, and it failed to recover in June. We suspect that the currency markets may bear the brunt of our persistent deficit spending.

Where do we go from here?

While some market questions have been resolved, more questions remain open. Nevertheless, we have learned some critical lessons in the quarter that shape our thinking about the rest of the year and beyond. Perhaps the most critical reminder is a pearl of wisdom from the late, great Byron Wien. Byron was a 70-year veteran of Wall Street and was the Chief Investment Strategist for Blackstone. On more than one occasion, he reminded us that “disasters have a way of not happening.” That isn’t a Pollyannaish worldview, but instead is a history-based reminder that we live in a remarkable time, and progress, despite setbacks, marches on.

Among the positives, the US economy’s economic resilience has been remarkable. While there is always something to be concerned about, the fact is that the economy has continued to grow and produce jobs. That, in turn, has kept corporate profits rising, which is the ultimate driver of stock prices. The inflation spike that was widely expected by the markets hasn’t materialized.

The result is a market making new all-time highs. While we didn’t officially see a 20% decline, which is the measure of a bear market, history suggests that recoveries like the one we have seen from near bear markets (i.e., a 19% decline) have occurred six times, with an average ensuing twelve-month return of 19%. Retail investors have been very enthusiastic about the market, driving speculative and lower-quality stocks higher while also pushing the broad market upward.

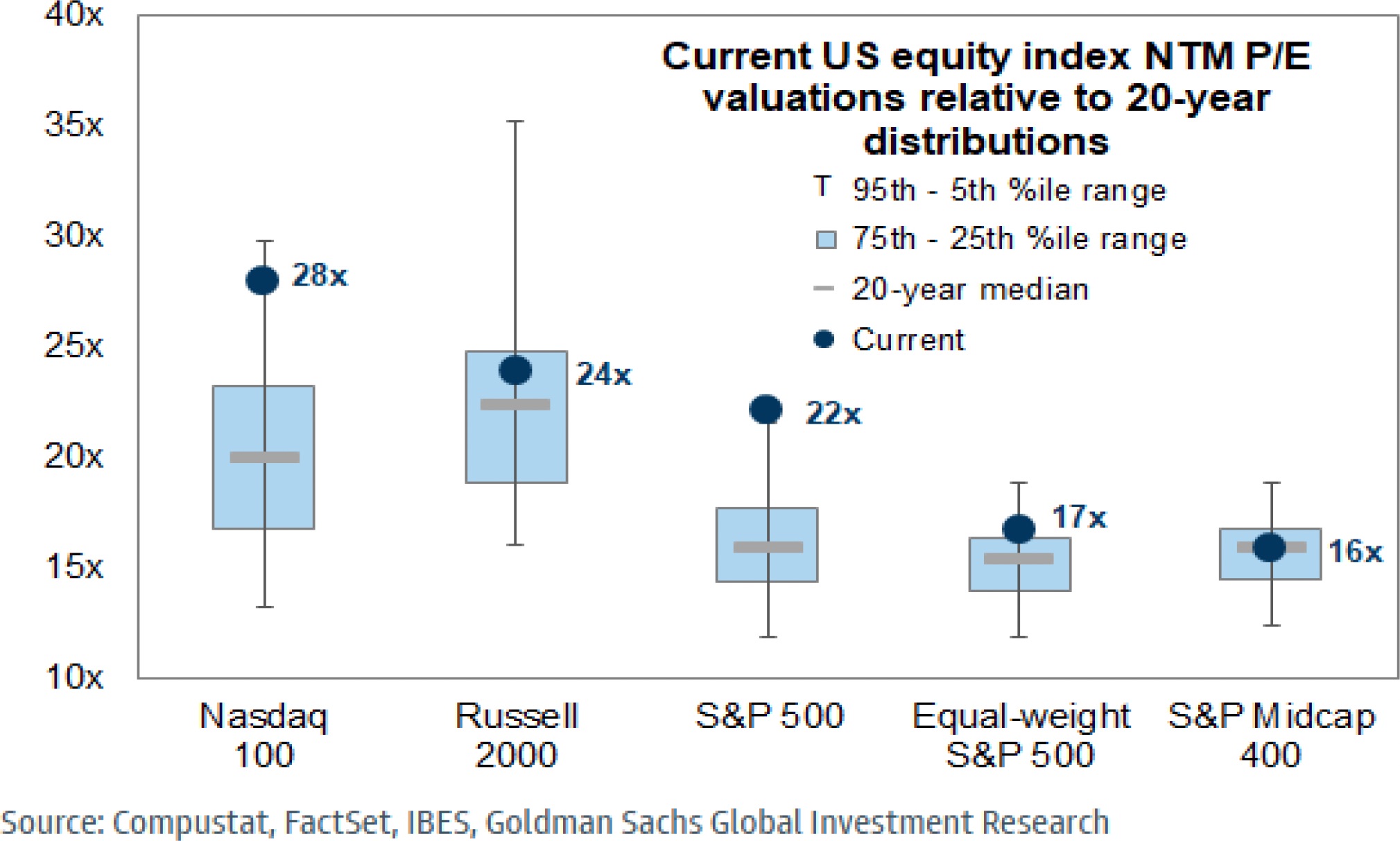

This enthusiasm for lower-quality securities is reminiscent of 2021 and the speculative fervor that accompanied the market’s peak that year. When accompanied by high valuations (see below), we are more cautious about the short-term outlook for the equity market (NTM P/E= next twelve months P/E).

As noted earlier, the Federal Reserve is keeping its interest rate cut powder dry. The Fed is likely to remain under heavy political pressure in the coming months to cut rates, but unless we see signs of a weaker economy, we believe they should resist that pressure.

Given the hyperactive news flow, we remain committed to tuning out short-term noise and focusing on the long term. To that end, we would like to highlight two topics that we believe are more important than is widely acknowledged.

Is immigration policy more important than tariffs?

Economic news has been mainly focused on the tariff issue. While this is important, we believe a case can be made that birth rates, immigration, and population growth are a much larger issue with profound, longer-term implications.

Our observations are not about the politics of immigration policy. The country has seen a sharp change from the Biden years, with largely unchecked immigration, to the Trump 2.0 years, where the border has been largely sealed and aggressive deportations have commenced. Reasonable people can differ about the policies, tactics, methods, and fairness of it all. Our concern is with the economic impact.

It has been observed that demographics are destiny for a country or a culture. If that is the case, there is much for the Western world and the United States to be concerned about. Growing populations provide the labor pool for all economic growth. If a country has a stagnant or even shrinking population, demand patterns change, and business models break or demand retooling.

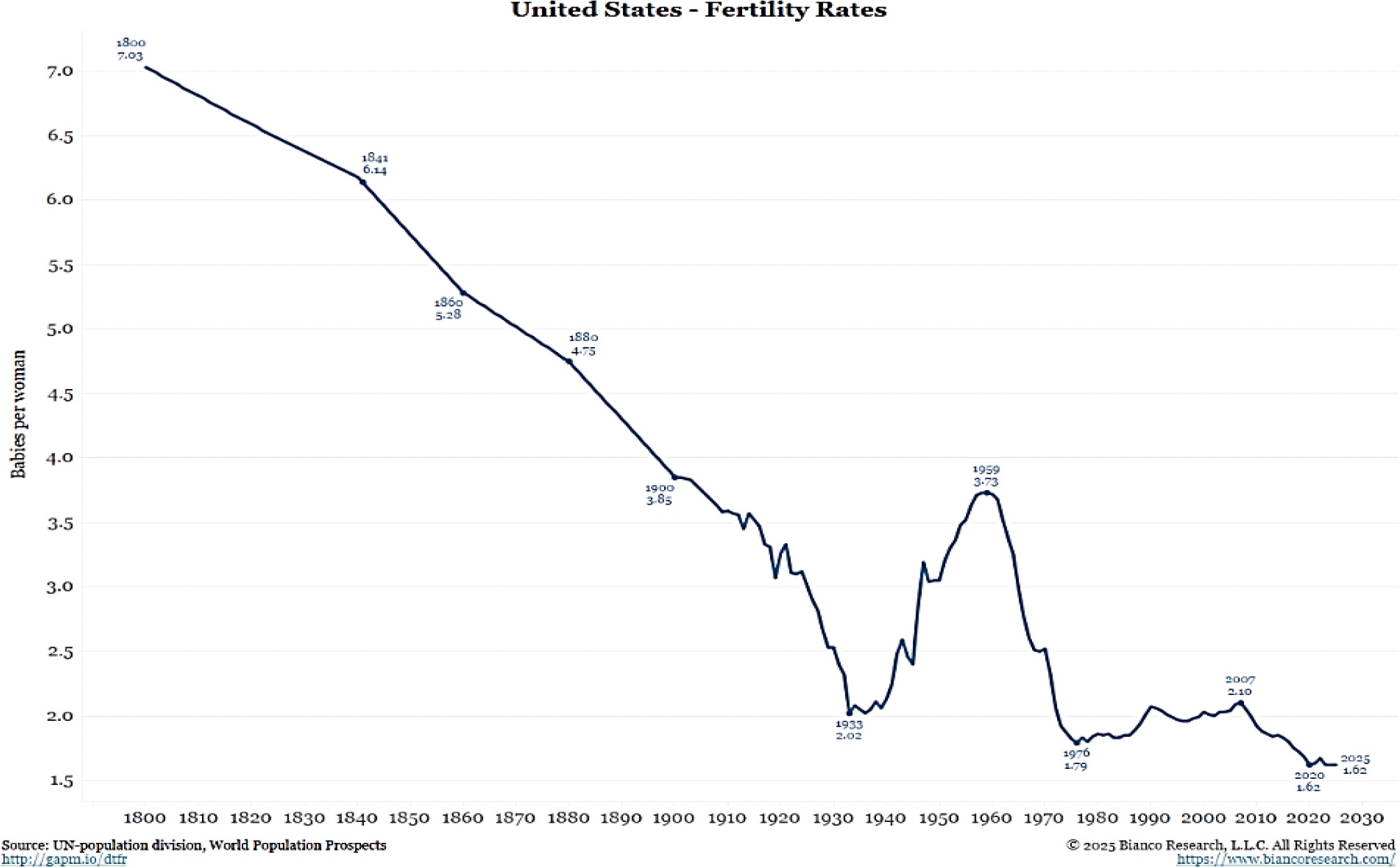

For any nation, the replacement birth rate is 2.1 births per female. This is the average number of children a woman needs to have to maintain a stable population. Many nations are well below that birth rate, including the US. As the graph indicates, 2007 was the last year that the replacement birth rate reached the magical level of 2.1.

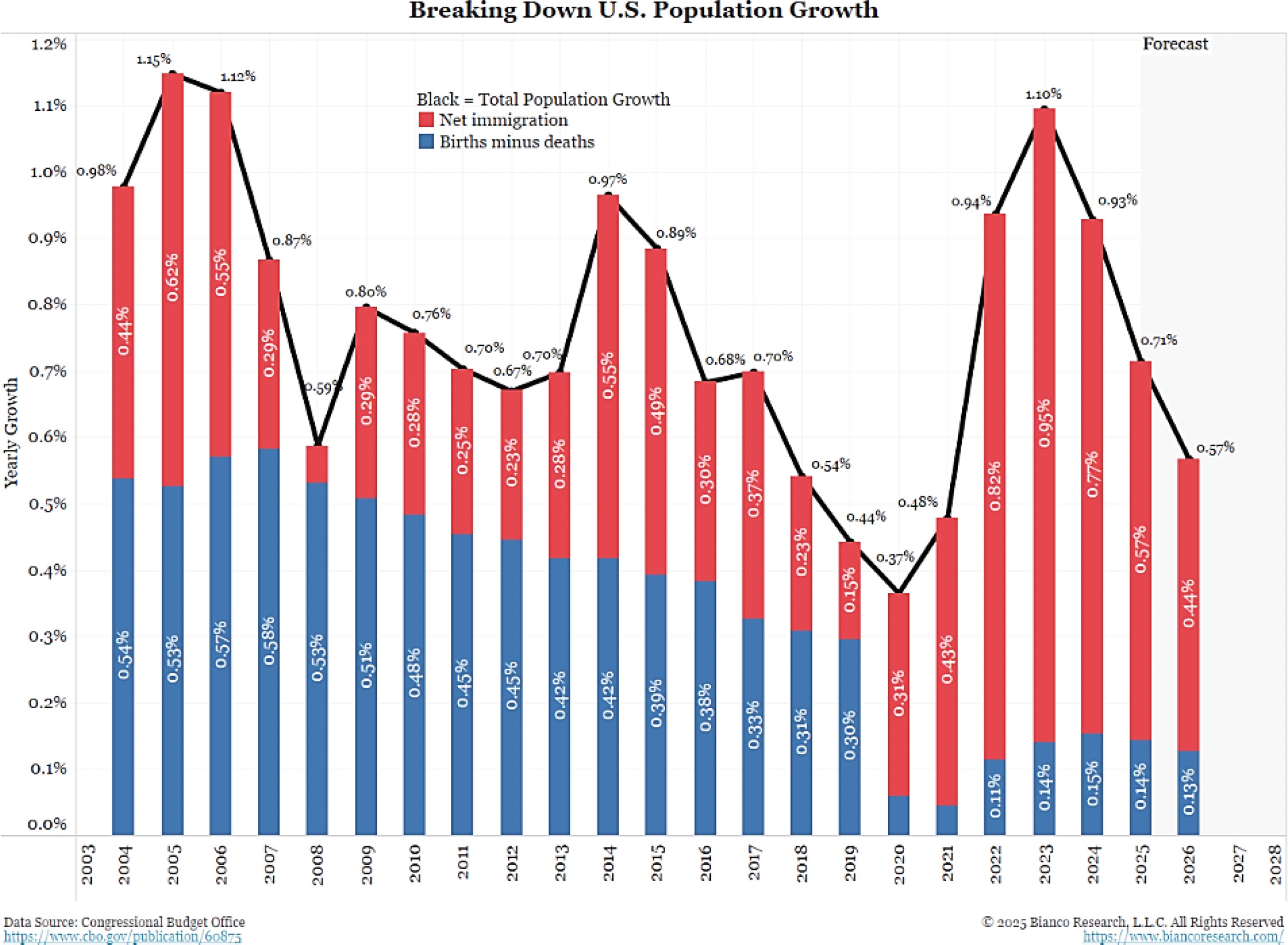

Many countries face a much more dire outlook. Japan’s population has already peaked and is shrinking, as is the case for China. Russia and most European nations have been below the 2.1 birth level for years, with little sign of improvement. For many of these countries, with little to no inbound immigration, the long-term social and political outlook is bleak. In the US, our low birth rate has been offset by immigration. The chart below illustrates the profound impact of immigration (both legal and illegal) on population growth.

In the near term, we suspect that if the border remains largely closed and deportations continue, population growth will flatline or even decline. This, in turn, will lead to stagnation in job growth. The American Enterprise Institute noted that under current policies, GDP may be lower by nearly .5% and monthly payroll growth could be flat to negative. No policymaker has confronted the prospect of a stable or even shrinking population.

How will this impact economic policy? How will the Fed react to flat job growth? In a world with a steadily increasing population, that data point might suggest a recession and prompt a quick cut in interest rates. However, if we don’t have enough workers, any job growth might be inflationary as businesses compete for scarce labor. Offsetting this, what happens to end demand for housing and other consumer goods? Might that demand force prices lower? Taken against the backdrop of tariff uncertainty, we sympathize with the Fed’s decision to remain neutral on rates. We can even envision a scenario, based on these factors and the OBBBA, where the next interest rate hike is anticipated.

The One Big Beautiful Bill Act (OBBBA)

While tariffs and trade wars have dominated the financial headlines, July 4 brought another market-relevant development: the signing of the One Big Beautiful Bill Act (OBBBA). Though branded as a populist win, the bill’s tax provisions are anything but simple. For households with significant income or wealth, the legislation contains a complex mix of permanence, phaseouts, and newly introduced planning tools—all of which deserve our attention.

At its core, OBBBA locks in many provisions from the 2017 Tax Cuts and Jobs Act (TCJA), which were previously scheduled to sunset after 2025. For most of our clients, this preservation means the current income tax structure remains in place: seven brackets, with a top marginal rate of 37%, and a widened gap between taxable income thresholds. The higher standard deduction, introduced in 2017, has also been made permanent at $12,950 for single filers and $25,900 for joint filers in 2025, indexed for inflation thereafter.

Although the application is more limited, new rules will allow for the exclusion of some tip and overtime income. The exclusions are capped, so the economic impact may be less than promised.

The state and local tax (SALT) deduction cap has been a sore point for clients in high-tax states. The new law temporarily raises the cap from $10,000 to $40,000 beginning in 2025, with 1% annual inflation adjustments through 2029. However, that relief is diluted quickly: for taxpayers with modified adjusted gross income (MAGI) above $500,000, the deduction begins phasing down by 30% of the excess over the threshold. Critically, the deduction cannot fall below $10,000; however, for many clients, that’s effectively where it will stay.

Itemized deductions are now reduced by 2/37 of the lesser of the total deductions or the taxpayer’s taxable income in excess of the top bracket threshold. This operates as a de facto haircut for those with significant deductions (such as charitable contributions, mortgage interest, and SALT) and high taxable income. In effect, the more you earn, the fewer deductions you’re likely to keep.

In the estate planning arena, the estate and lifetime gift tax exemption has been permanently increased to $15 million per individual (or $30 million per married couple) beginning in 2026, with inflation indexing to follow. This expansion presents new strategic opportunities for clients who have already utilized their prior exemption or have significant remaining gifting capacity.

For clients who own closely held businesses, the 20% qualified business income (QBI) deduction under Section 199A is preserved and expanded. The phase-in thresholds for specified service businesses are increased to $150,000 for joint filers (up from $100,000), offering broader eligibility. Additionally, an inflation-adjusted minimum deduction of $400 has been introduced for active participants in qualified trades or businesses with at least $1,000 in QBI. While this may be modest in isolation, the reaffirmation of 199A’s permanence gives business owners more certainty in their income planning.

One of the more intriguing additions is a new tax credit, not a deduction, for charitable contributions to approved scholarship-granting organizations. Taxpayers may claim the greater of $5,000 or 10% of AGI as a credit, capped nationally at $4 billion per year beginning in 2027. This credit is allocated on a first-come, first-served basis. It provides a rare dollar-for-dollar reduction in federal income taxes, making it potentially more attractive than traditional charitable giving deductions.

The bill also repeals many of the “green energy” tax credits and deductions that were included in the Inflation Reduction Act. If you are considering buying an electric vehicle, time is of the essence, as those credits will expire on September 30, 2025. Home improvements to enhance energy efficiency will end on December 31, so once again, acting sooner rather than later can preserve your tax benefits for these purchases.

Other highlights of note include the following:

- Senior Deduction: Taxpayers age 65+ will receive a temporary $6,000 deduction from 2025–2028, which phases out at $75,000 MAGI for individuals or $150,000 for joint filers.

- Mortgage Interest Deduction: The TCJA’s cap of $750,000 in mortgage debt for interest deductibility is made permanent.

- Charitable Contributions: Non-itemizers will now be able to deduct up to $2,000 in qualified charitable contributions ($1,000 for single filers). Itemizers face a new 0.5% floor: their charitable deduction will be reduced by 0.5% of their contribution base.

- Alternative Minimum Tax (AMT): AMT exemption levels are preserved but now phase out faster (50% of excess AMTI over threshold vs. 25%).

Despite the “beautiful” branding, this legislation is more a codification of the existing tax structure than a true reset. For high-net-worth households, it preserves favorable provisions while inserting subtle frictions through phaseouts, floors, and deductions that become less valuable as income rises. On the upside, the permanence of many rules, especially those related to estate tax exemptions and business income, offers welcome clarity for planning.

That said, many provisions sunset, phase out, or evolve over time. Credits like the scholarship-giving incentive have annual caps that will be exhausted early. Higher SALT deductions exist in theory but may be inaccessible in practice. And new floors on itemized deductions and charitable gifts add complexity that rewards early and proactive planning.

We will continue to review the technical guidance and flag specific opportunities as we meet for reviews. In the meantime, clients with sizable estates, charitable ambitions, or business ownership should consider this an opportune moment to revisit their tax strategy.

Summary

Over the past three months, our conviction that flawed policies can be rectified by more effective ones has been vindicated. Unfortunately, we have also seen that some bad policies can persist or even worsen. It seems clear that the global economy and markets are increasingly captive to the whims and wishes of policymakers. Some are elected and politically accountable, and some are not, but all of them have more influence than we would prefer. As long as that remains the case, inflation is likely to persist. That prospect will significantly influence our thinking as we anticipate and react to policy changes and market fluctuations.

As always, we will continue to be vigilant in managing risks and identifying opportunities that align with your needs and goals. Please share your thoughts, questions, and concerns with us.