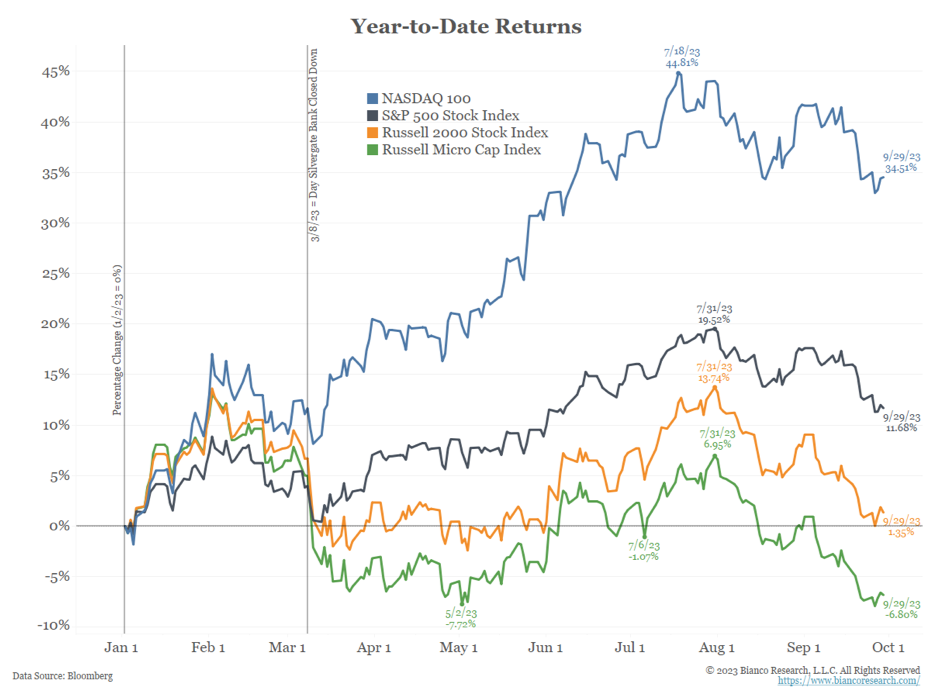

After a strong first half to 2023, global equity markets declined in the third quarter. The S&P 500 Index reached a 2023 high at the end of July, but from its intra-quarter high the index declined 6.3% through the end of September. This was the second meaningful decline this year; the S&P 500 fell 7.5% in February and March during the regional banking failures. Despite the decline, the index is still up 13.1% year to date.

After a strong first half to 2023, global equity markets declined in the third quarter. The S&P 500 Index reached a 2023 high at the end of July, but from its intra-quarter high the index declined 6.3% through the end of September. This was the second meaningful decline this year; the S&P 500 fell 7.5% in February and March during the regional banking failures. Despite the decline, the index is still up 13.1% year to date.

Small-cap stocks (Russell 2000 Index) also had momentum early in the quarter but changed course and ended the quarter down 5.1%. Year-to-date, small-cap stocks are still up 2.5%, but meaningfully trail large-caps. On a style basis, growth stocks lagged value stocks during the quarter as the energy sector enjoyed a strong third quarter.

Last quarter, we noted the fact that stock gains have remained unusually narrow, with the largest stocks in the index leading the way. The standout performers are those sectors with the largest stocks, while most other sectors have been relatively flat. Consumer discretionary has been driven higher by a 51% gain from Amazon.com and a 103% return from Tesla. The information technology sector has outperformed thanks to Apple (32%), Microsoft (33%) and NVIDIA (198%). Communication services has been propelled higher by a 48% return for Alphabet and 149% from Meta Platforms. These seven stocks make up the “Magnificent Seven” that account for the majority of year-to-date returns of the S&P 500. Further illustrating the market-cap effect, the equal-weighted S&P 500 index is roughly flat this year through September. This concentration continues to remind us of the dot com bubble. At that time, good news, bad news or no news made investors want to buy the tech darlings. Today, it can be falling rates from a bank crisis, revolutionary new technology like AI, or fears of recession making the quality balance sheets of these companies look good. Whatever the case, investors continue to focus on these seven names.

Within foreign markets, developed international stocks (MSCI EAFE) declined 4.1% in the quarter, and are up roughly 7.1% year-to-date. Emerging-markets stocks (MSCI EM) fell 2.9% in the quarter and are up 1.8% this year through September. The U.S. dollar (DXY Index) surged over 3% during the quarter, resulting in a headwind for foreign markets.

To our way of thinking, fixed income markets were the story of the third quarter and remain the dominant issue for all financial markets. Core bonds (Bloomberg U.S. Aggregate Bond Index) fell 3.2% in the quarter as interest-rate rose. The benchmark 10-year Treasury yield climbed nearly 70bps in the quarter, ending the period with a 4.59% yield, the highest level since 2007. High-yield bonds (ICE BofA US High Yield) managed to eke out a small quarterly gain and are up 6% for the year-to-date period.

The Economic Backdrop

As the third quarter began, a consensus emerged that the Fed was well on way to engineering the elusive economic soft landing. Inflation that had reached nearly double- digit levels in 2022 was coming down with an assist by Fed interest rate hikes. Employment remained remarkably strong, and the Fed was in a position to not only stop raising interest rates, but likely to begin thinking about rate cuts. Falling interest rates are manna from heaven for equity investors so they bid stock prices up in anticipation of this happy outcome.

The reality of the third quarter has not been as friendly. While there can be no doubt that inflation has come down, it remains uncomfortably high for consumers and the Federal Reserve. As we pointed out last quarter, it seemed unlikely that inflation would fall back to the Fed’s target of 2%. While it is true that higher rates are pinching some segments of the economy, we would suggest that all of the Fed’s hard work is being offset by fiscal policy.

We are referring to the staggering size of Federal deficits. At the end of September, all eyes were on the threat of a government shutdown, then on the ouster of the Speaker of the House. Lost in the reporting was attention to the fact that in a time of peace, with unemployment below 4%, we just concluded a year with a $2 trillion deficit. And there is more to come. This type of deficit spending is what you would expect from the government endeavoring to stimulate an economy in recession. Instead, it is happening ahead of the recession and feeding the inflationary beast.

Fed members have said often and repeatedly that they believed they weren’t done raising rates and would likely need to keep already elevated rates higher for a longer time than the markets seemed ready to accept. As the summer dragged on and the evidence continued to mount that inflation wasn’t vanquished, it finally seemed to dawn on the markets that maybe the Fed was serious. While the Fed has dramatically slowed the pace of rate hikes and is clearly closer to the end than the beginning of this cycle, it is important to remember that the Fed only controls short term rates. Longer- term rates are set by the market and those have moved up sharply. As noted earlier, benchmark 10- year Treasury rates are now at the highest levels since before the financial crisis.

This is particularly relevant since most individuals are impacted far more by long than short rates. Small businesses also borrow with reference to long rates. Milton Friedman taught us that monetary policy (i.e., rate changes) works with a long and variable lag. We just don’t know how long or how variable the lag is.

There can be no doubt that rising rates are beginning to bite but despite 550 basis points of hikes, the US economy has remained resilient. It is hard not to be impressed by the strength of the job market. Although the pace of job growth has slowed, the most recent reports of more than 300,000 jobs being created last month, with a resulting unemployment rate of 3.8%, suggest that momentum is strong.

Market Outlook – Fourth Quarter and 2024

Any discussion of the direction of asset prices must begin with a focus on interest rates. Prices are the economy’s signaling mechanism, and the price of money is the most important price because it is the price that determines how capital is allocated. Having more and rational interest rates will, over time, lead to more efficient allocation of capital, which is a positive.

The question today is whether the rate breakout is over. We are skeptical. Fifteen years of monetary and fiscal policy distortions are going to take longer to work through the system. Even if higher rates slow the economy, they may not reduce price pressures. Two issues are of particular concern. The first is that higher rates are acting as stimulus for savers. After years when savings earned nothing, today’s interest rates put lots of spendable income in the hands of a segment of the population. Secondly, what if a recession creates demand for even more government spending? In that instance, inflationary pressures may keep the Fed on the sidelines and rates higher than investors think. Against that backdrop, we don’t think a bet on falling rates is a good one and we remain biased toward taking advantage of today’s higher short-term yields.

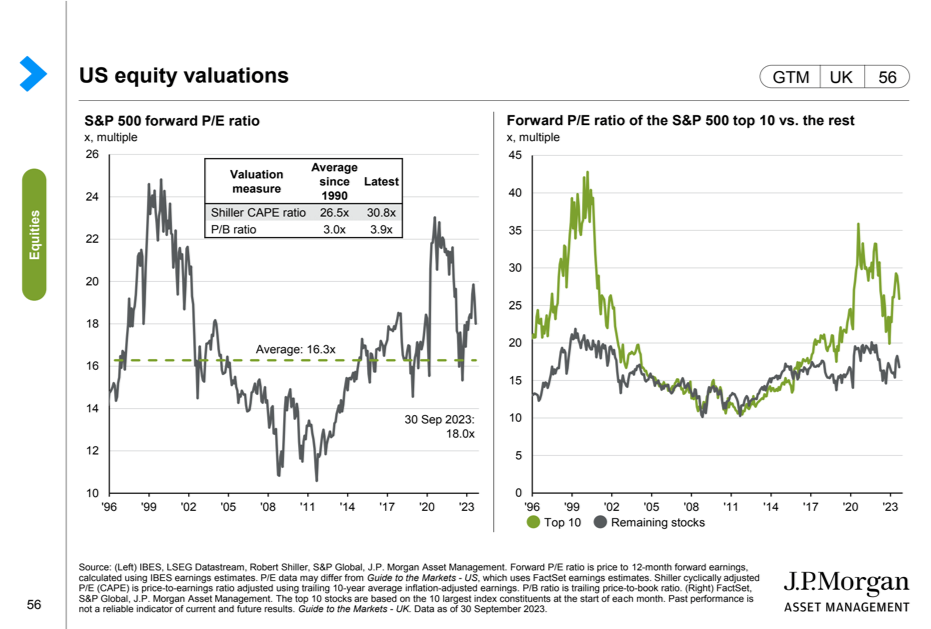

With respect to the stock market, earnings have remained resilient in the face of higher inflation and higher interest rates. If corporate America can continue to manage costs and pass through price increases to customers, equities will work their way higher. We suspect, however, that the pace of progress may disappoint because valuations are not cheap.

Valuations are the north star for investors. If you overpay for an asset, making a reasonable return is very difficult. If you buy an asset on the cheap, the built in margin of safety gives you a much greater chance of weathering the vagaries of the economy and markets and realizing attractive returns. In the short term, this relationship doesn’t mean much.

Valuations are the north star for investors. If you overpay for an asset, making a reasonable return is very difficult. If you buy an asset on the cheap, the built in margin of safety gives you a much greater chance of weathering the vagaries of the economy and markets and realizing attractive returns. In the short term, this relationship doesn’t mean much.

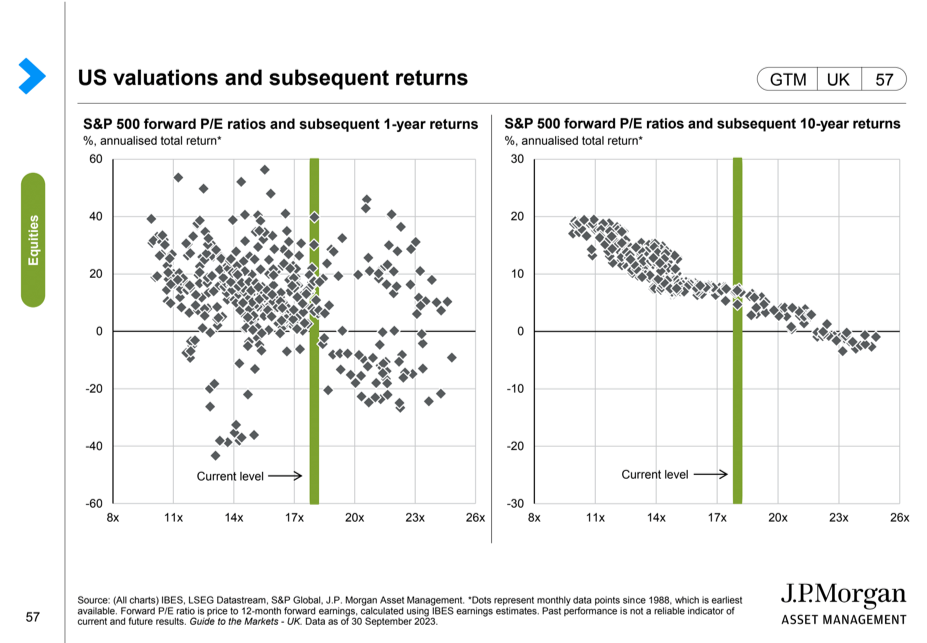

Cheap assets can get cheaper and expensive assets can remain overpriced longer than you can believe. This is highlighted in the chart with a very random pattern of valuations and returns on a one- year basis contrasted sharply with the tight and predictable ten-year returns for cheap versus dear assets.

Cheap assets can get cheaper and expensive assets can remain overpriced longer than you can believe. This is highlighted in the chart with a very random pattern of valuations and returns on a one- year basis contrasted sharply with the tight and predictable ten-year returns for cheap versus dear assets.

Summary

The more things change, the more they stay the same. Policy makers erred in allowing inflation to gain a foothold. The battle to tamp down inflation will be longer, and more challenging, than most believe. Until inflation is subdued, and interest rates stabilize, risk asset markets will be volatile. We remain cautious but attentive for the opportunities that come from market instability and chaos.