Happy New Year! Investors around the world had much to be grateful for after a terrific 2025 across financial markets. At the beginning of October, we highlighted how unusual it was to see all major assets in positive territory on a trailing one-year basis. While returns were more modest in the final quarter of 2025, for the calendar year, only the dollar declined among major assets. Given political upheavals, ongoing conflicts around the world, and high valuations, this would not have been our prediction for 2025.

A closer look at the results for the year yields some surprises. Foreign markets led the way in 2025. Commodities in general performed well, with gold and precious metals being particularly noteworthy. The strong performance for equities in general and foreign stocks in particular was a surprise after “Liberation Day.” The consensus after Liberation Day was that the US had fired the first shots in a new, global trade war. Higher inflation, lower economic growth, and restrained global trade were certainties. None of these came to pass. While artificial intelligence (AI) dominated investor thinking, any discussion of AI inevitably worked its way around to an acknowledgement of “American Exceptionalism.” The basic notion behind American Exceptionalism is that a superior system (economic, educational, and legal) has created an environment where US companies and markets flourish, often at the expense of foreign markets. While US tech stocks had another strong year, concerns began to emerge about the huge capital outlays being devoted to AI and whether returns will ultimately justify these expenditures. There is more to this story in 2026.

Part of what made 2025 so unpredictable was the wild year in politics and world affairs. A new administration in Washington seemed to reverse every policy from the Biden administration. Liberation Day and trade turmoil panicked the markets for a short time, but as the Trump administration seemed willing to negotiate (hence the new acronym, TACO or “Trump always chickens out”), asset prices recovered and reached new highs. In the fall, we endured the longest government shutdown in history. As usual, the shutdown seemed to accomplish nothing but hurt and inconvenience many.

The ongoing war in Ukraine and the inability to reach a peace agreement no longer seemed top of mind for investors. Developments in the Middle East received more attention, especially after the US bombed Iranian nuclear assets in the summer. While this led to a ceasefire in Gaza, no one would say there is peace in our time.

Any hope for a quieter 2026 was already put to bed in the first week of the year. As the year dawned, widespread protests in Iran seemed to have the government on its back foot. Drought, economic sanctions, and ravaging inflation have put the populace in poor humor. Will this be the year for regime change in Iran? Only time will tell, but in Venezuela, we know a change has already taken place. The daring US military raid to arrest Nicholas Maduro and his wife has clearly altered the path for that country. The pretext of a law enforcement exercise appears weak, given that the administration has effectively revived the Monroe Doctrine and made clear its desire to exercise extensive control across the Western Hemisphere. International relations will never return to the status quo that existed between the fall of the Berlin Wall and Russia’s invasion of Ukraine.

A Brief Look Back at 2025

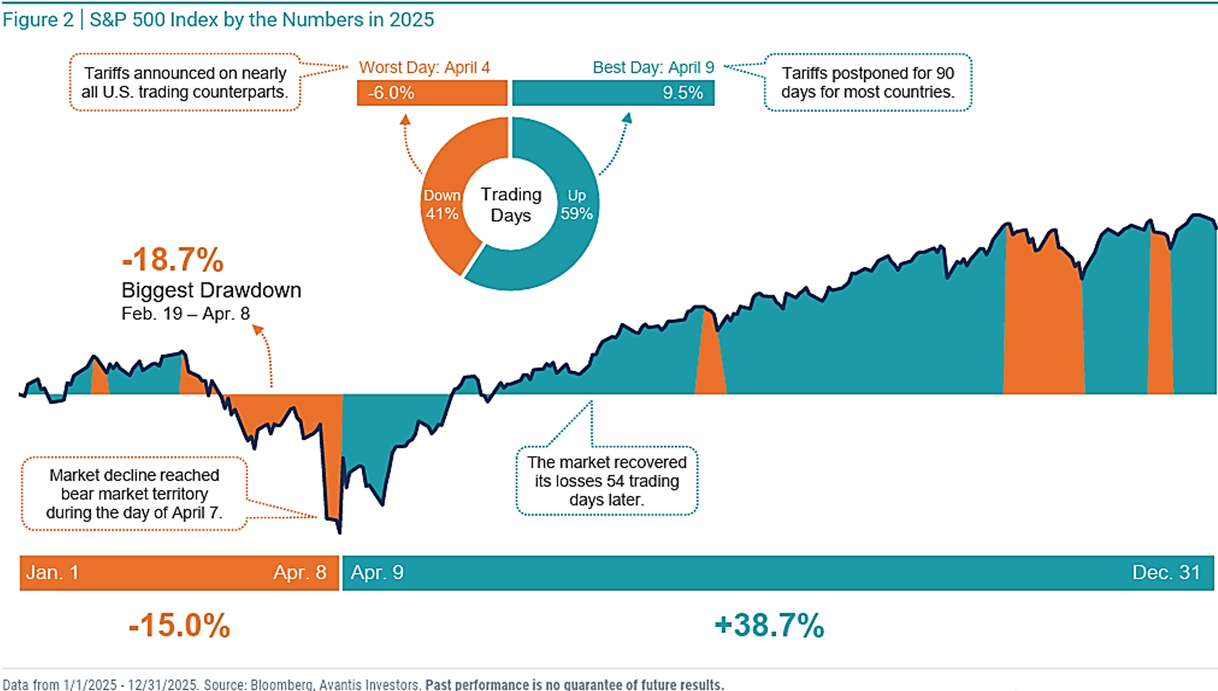

Looking back, despite the turmoil, it was a year that actually reinforced many time-tested principles. First, and most importantly, volatility is a part of investing. The 2025 rollercoaster illustrated below highlights the wild swings. April was particularly turbulent as tariff announcements, followed quickly by the administration’s backtracking, created huge up and down swings within the same week.

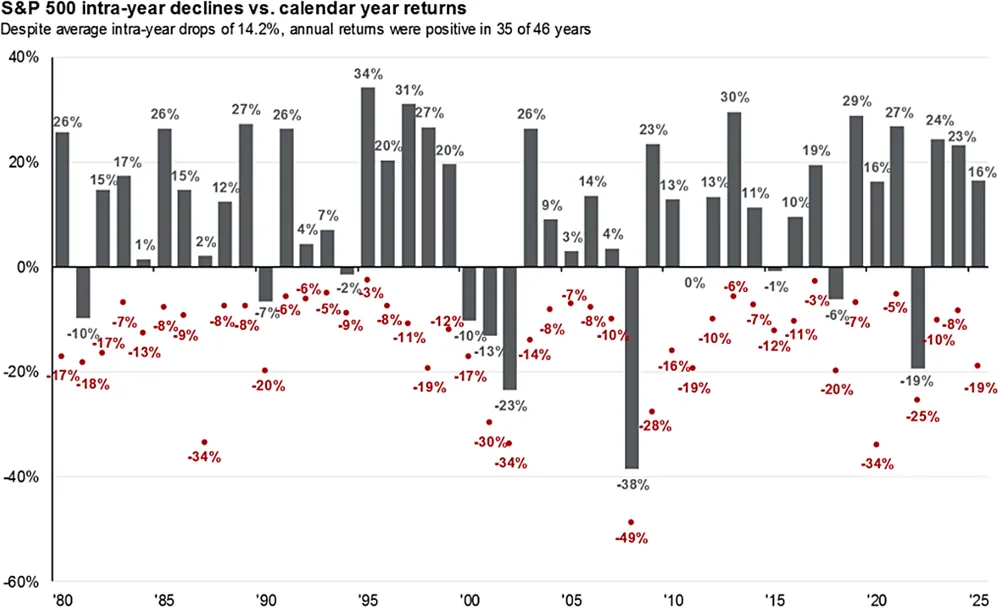

While these swings were very dramatic, they are not at all unusual. JP Morgan has a terrific chart to help maintain some perspective on annual market returns compared to the worst drawdowns during each calendar year:

This highlights the fact that volatility in equities is simply the price investors must pay for the growth potential of equities. Because this level of volatility can be so unnerving, investors who don’t want the wild ride have different choices. Some endeavor to time the market by jumping in and out. This has always and everywhere proven to be a fool’s errand.

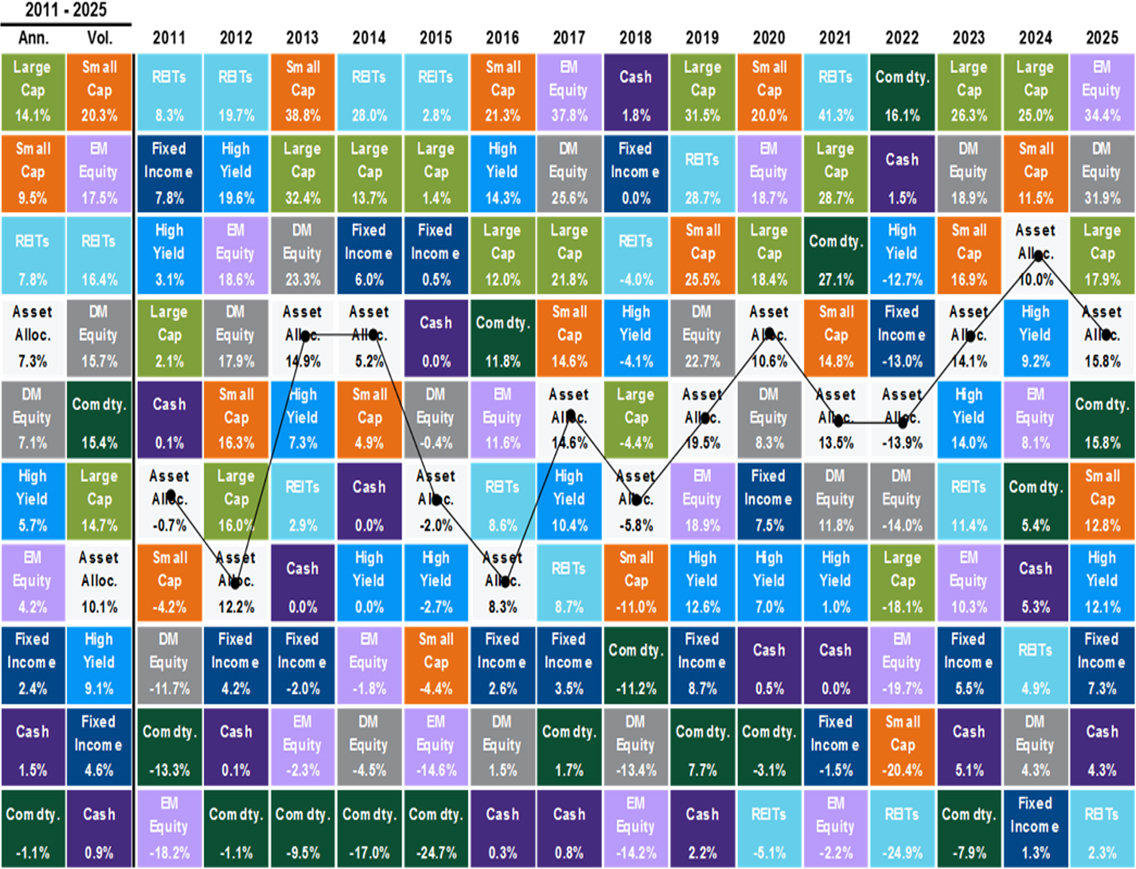

More successful investors rely on time (i.e., longer holding periods smooth returns) and diversification (combining assets with low correlations to improve returns:

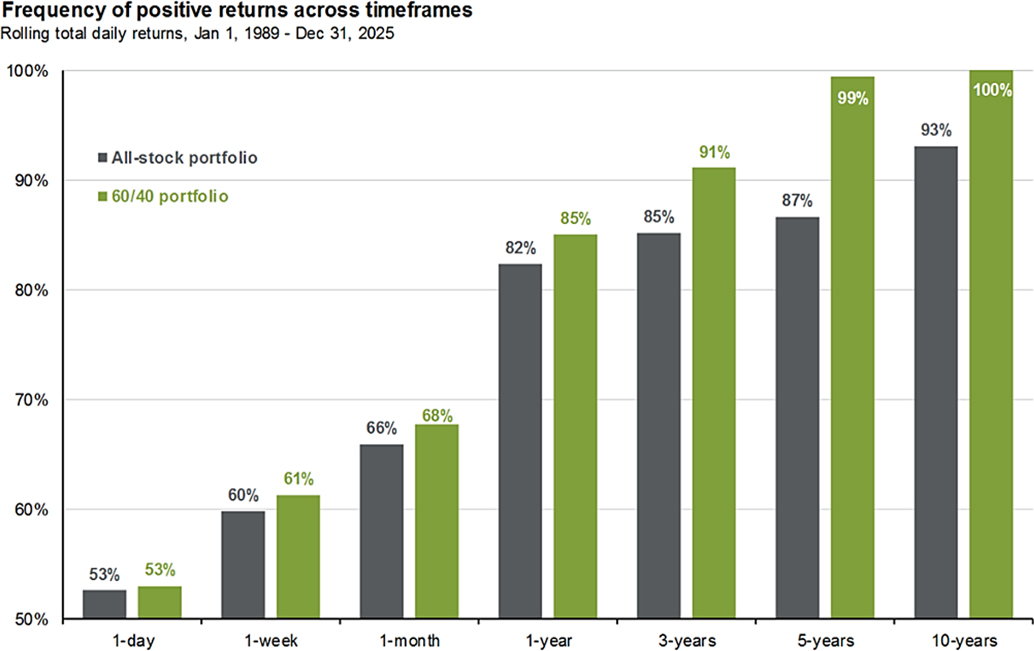

An alternative way to consider the benefits of diversification and holding period is to analyze the frequency of positive returns. On a given day or week, the results for an all-stock portfolio versus a diversified portfolio are a coin toss. For every long-term period, however, diversification meaningfully reduces the likelihood of negative returns:

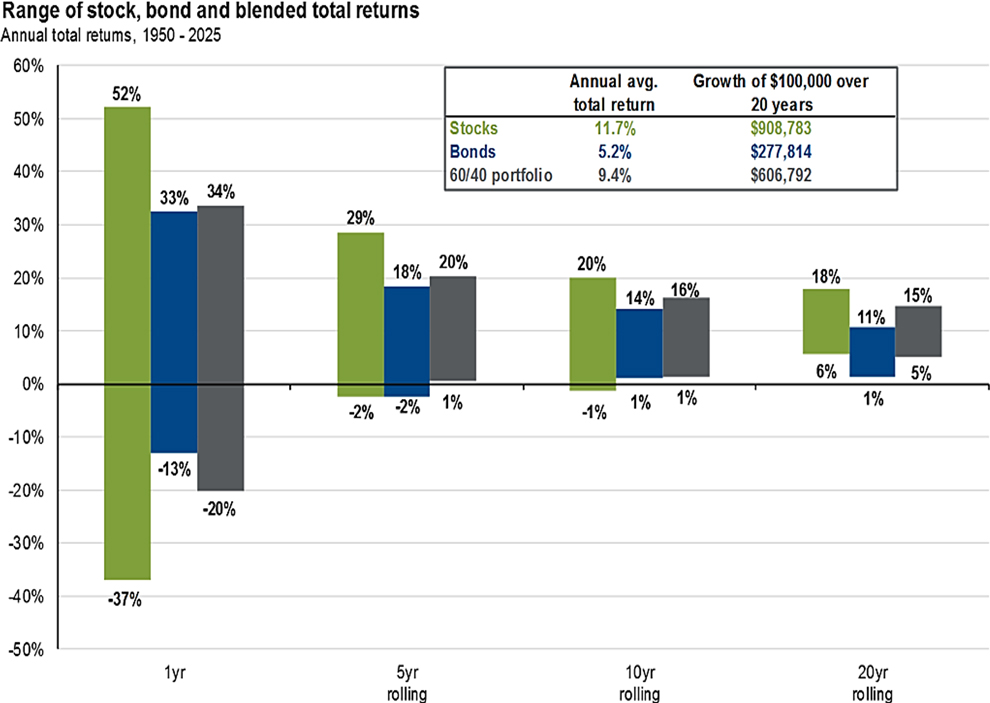

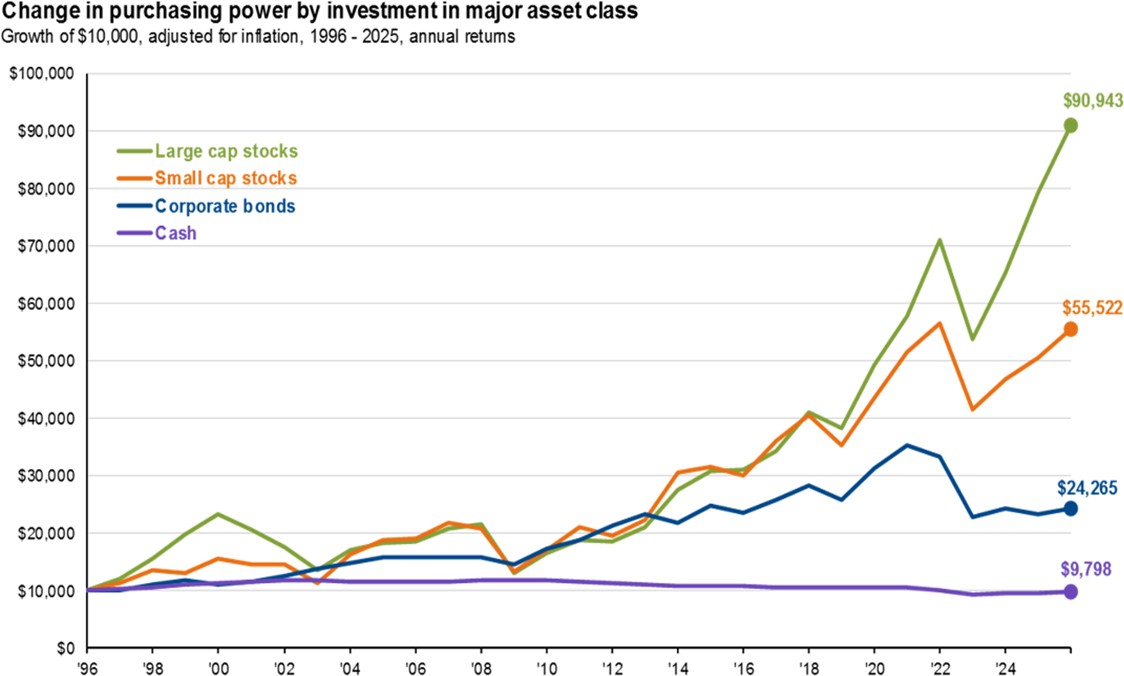

Finally, 2025 was a reminder that for investors willing and able to shoulder risk, the long-term returns are noteworthy:

The 2026 Outlook

We enter 2026 with world markets advancing. As we consider what the new year holds, it is easy to get lost in the blizzard of data and conflicting views. We would draw your attention to four observations, beginning with valuation.

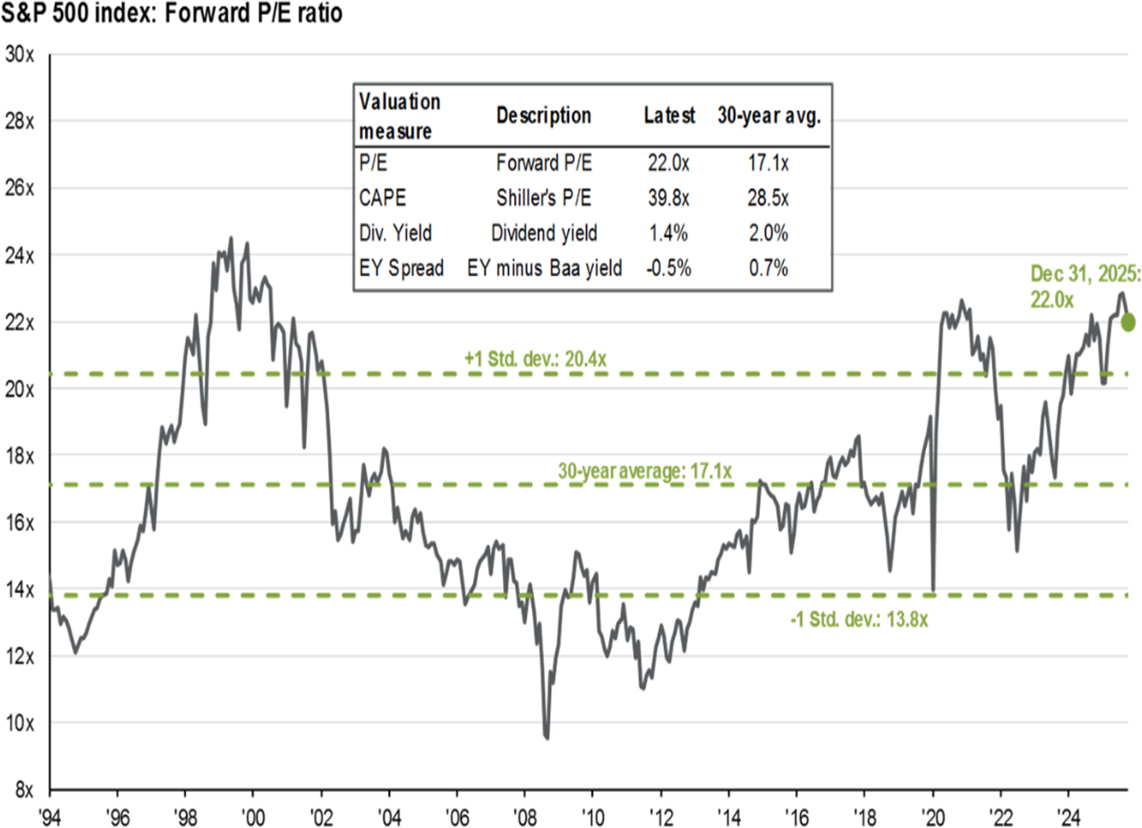

As we have discussed often, equity market valuations are rich. That simple and widely known fact tells us little about how markets may behave in the coming year because value is a terrible short-term indicator. Overvalued assets can remain overvalued and become more overvalued for longer than anyone can imagine. Similarly, undervalued assets can remain “cheap” for longer than an investor can bear. What valuations do hint at is the extent of risk embedded in markets.

At year’s end, the S&P 500 traded at a forward price earnings (PE) ratio of 22:

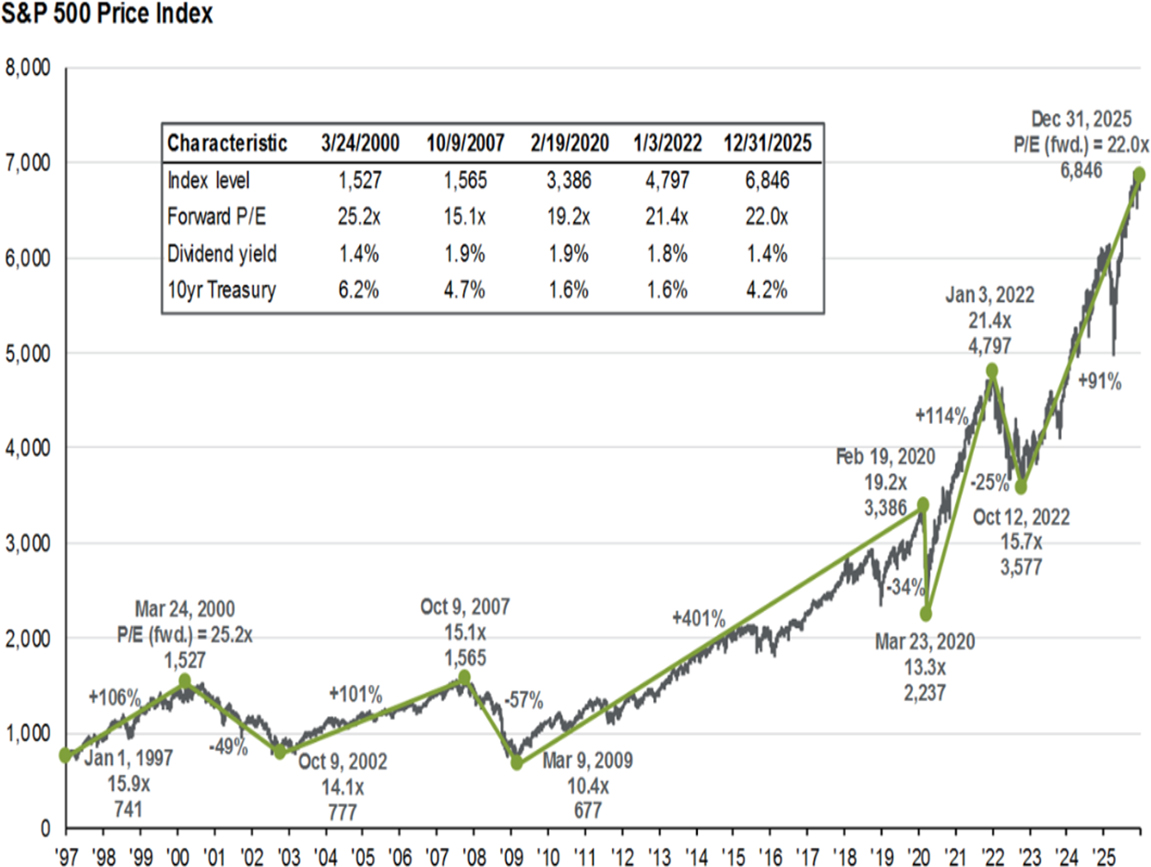

It is interesting to look back and compare this and other valuation metrics at critical market junctures. At the beginning of the 2022 bear market, the forward PE was 21.4 times. This suggests that market gains over the past four years came primarily from strong earnings growth for US companies:

This observation, that earnings growth has remained strong despite elections, wars, tariffs, inflation, and interest rate changes, is what gives us optimism about 2026. The combination of declining inflation, strong expected earnings growth, and lower interest rates makes it hard to bet against equities in the coming year.

With respect to inflation, we have been nervous about it for some time, and still fret about massive government deficits as a driver of higher prices. However, when the data changes, we need to adjust our thinking, and the fact is that tariffs haven’t pushed prices higher, and we see signs of declining inflation in many areas. Gas prices are lower (we saw unleaded below $2/gallon over the holidays), and rents are coming down. Those are important elements of the inflation equation, and the changes are showing up in some of our favorite inflation gauges, including TruCPI, the open-source, daily-updated index from Truflation. The index fell to 1.95% as of January 1st, as compared to the BLS-reported rate of 2.70%.

Earnings growth is forecast to be in the range of 15% this year. Early-year forecasts are notoriously optimistic, but double-digit earnings growth doesn’t seem like an unreasonable expectation, and that earnings growth is the ultimate driver of equity prices.

Finally, the Fed has cut interest rates three times since the fall, and markets anticipate two more rate cuts in 2026. With a new Federal Reserve chair likely to do the administration’s bidding, it seems likely that rates will be lower this year.

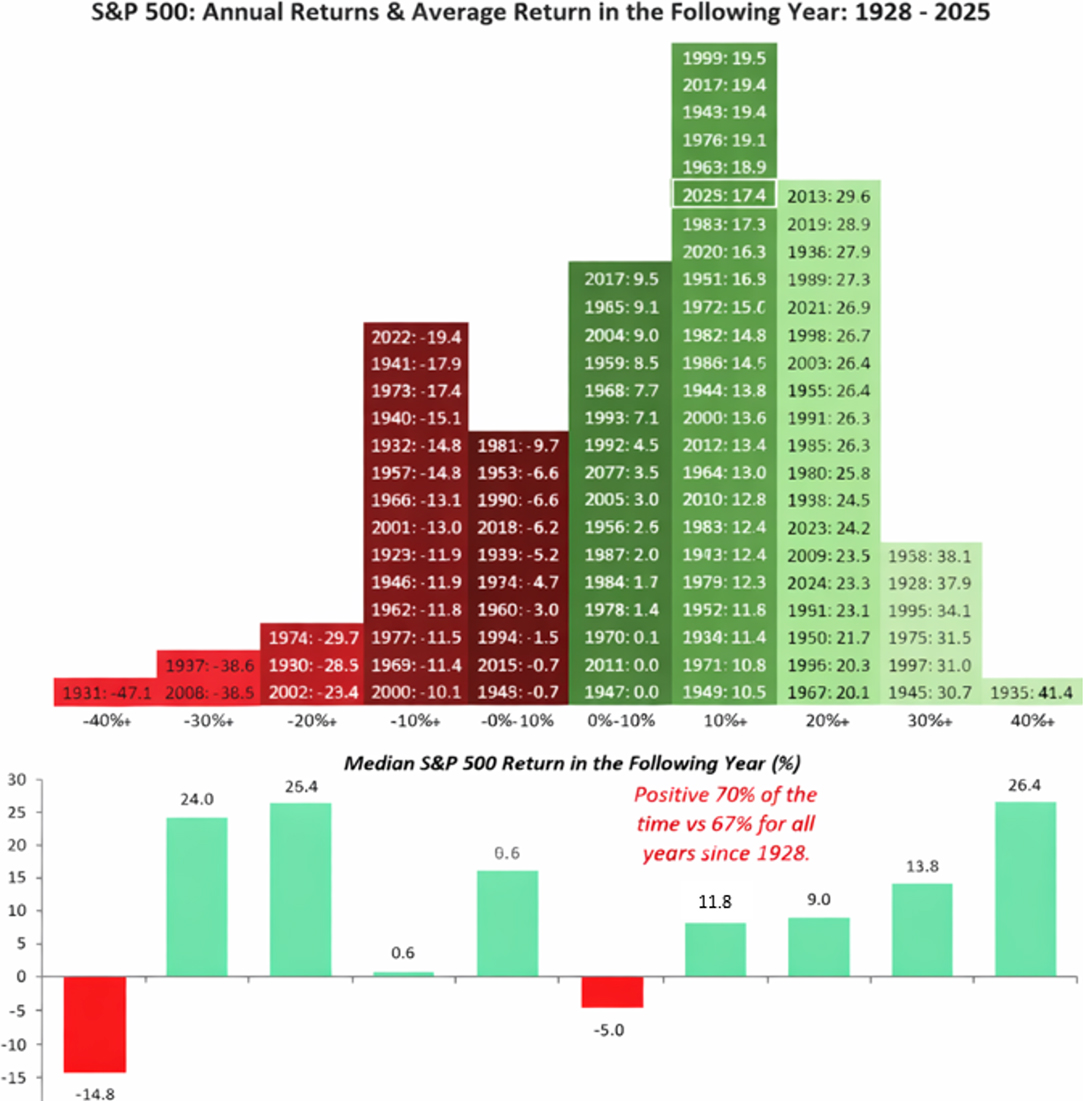

Taken together, lower inflation, higher earnings, and declining rates point to higher equity prices. The second year of a Presidential cycle typically isn’t the best for equities, but momentum is a powerful and potentially offsetting force. As Bespoke points out in the chart below, years of double-digit returns are followed by double-digit returns 70% of the time.

Our optimism is tempered by starting valuations, so our focus in the new year will be on further diversifying portfolios and keeping a close eye on liquidity needs so that when (not if) the turmoil we experienced in April is repeated, all of our clients will remain patient and disciplined.

Summary

2025 was a memorable year in so many ways. It was an excellent year for investors and one that underscored the principles that we apply in managing your portfolio. As 2026 unfolds, we look forward to the continued opportunity to be of service and welcome your thoughts, questions, and concerns. We are also looking ahead to the 2025 tax filing season. As tax data begins to roll into your mailboxes, we would encourage you to be patient and allow for the receipt of all of your data, including corrected 1099s. Filing early often requires amendments later, so patience is a virtue when preparing for 2025 filings.