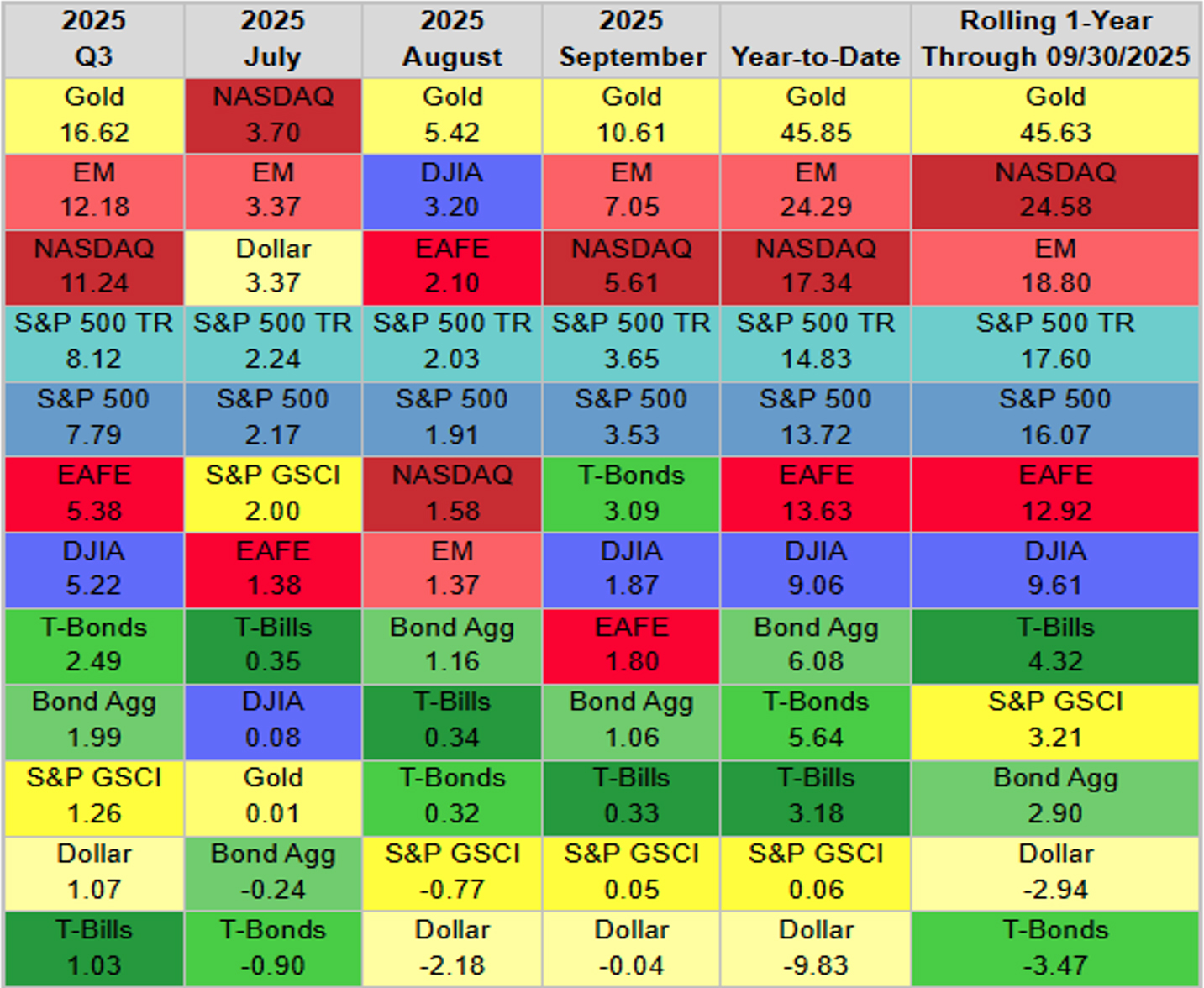

Financial markets worldwide continued to rally in the third quarter of the year. The panic of Liberation Day, now seven months past, seems a distant memory. Equities continued to rally as fears of recession gave way to fears of missing out (FOMO) on the AI capital investment boom. Fixed-income markets rallied as the world’s central bankers became more accommodative. In fact, in the last two months, not a single central bank has raised interest rates. Even the Fed got in the act, as Jerome Powell, bruised and bloodied by Presidential criticism, led the Fed in a 25-basis-point rate cut in September and another 25 basis points in late October. Gold actually led broad asset returns in the quarter. It is unusual ( you have to go back to the first quarter of 2019) to see a period when everything goes up, as highlighted in the asset return quilt for the quarter.

Foreign markets continued to post good results. While the dollar rallied modestly over the quarter, it remains significantly lower year-to-date, enhancing the attractiveness of foreign assets and currencies to US investors. As always, geopolitics remains a sore spot. The war in Ukraine grinds on despite the mid-August Alaska Summit between Putin and Trump. The Middle East, as we write, seems closer to some resolution in Gaza, but it apparently took an Israeli attack on Qatar to change those dynamics.

Politics in the US is also unsettled. The President remains a deeply divisive figure. Congress remains dysfunctional, as evidenced by the ongoing government shutdown. We know from history that government shutdowns don’t really help anyone. Both sides hope for political advantage, and talking heads will debate about who the winners and losers are. In the meantime, some services will be suspended, and many government employees will work unpaid. When the shutdown ends, most will be made financially whole, but the work that was missed only gets pushed off. Regardless of someone’s politics, all can agree that this is no way to run a nation.

As we look ahead to the final months of 2025, numerous cross-currents will impact the economy and markets. We have opinions about each of these topics, but are humble enough to recognize that anyone who claims to “know” how these matters will unfold in the coming months is fooling themselves and others. We think it is more useful to consider a range of outcomes on the issues of the day.

Tariffs

When Liberation Day took place, we were on record as opposing the President’s plans. Tariffs are taxes, and we don’t think the world suffers from too little taxation. Even if one favors higher taxes, tariffs are an inefficient tax with significant distributional problems. We also value predictability in public policy, and the rollout and imposition of the President’s tariff policy has been arbitrary, capricious, and haphazard. Not only has the policy implementation been chaotic, but it may also be illegal. The President’s use of emergency economic powers has been challenged, and the question will ultimately have to be settled by the Supreme Court, where arguments took place just recently. Our distaste for the way this has unfolded hasn’t changed.

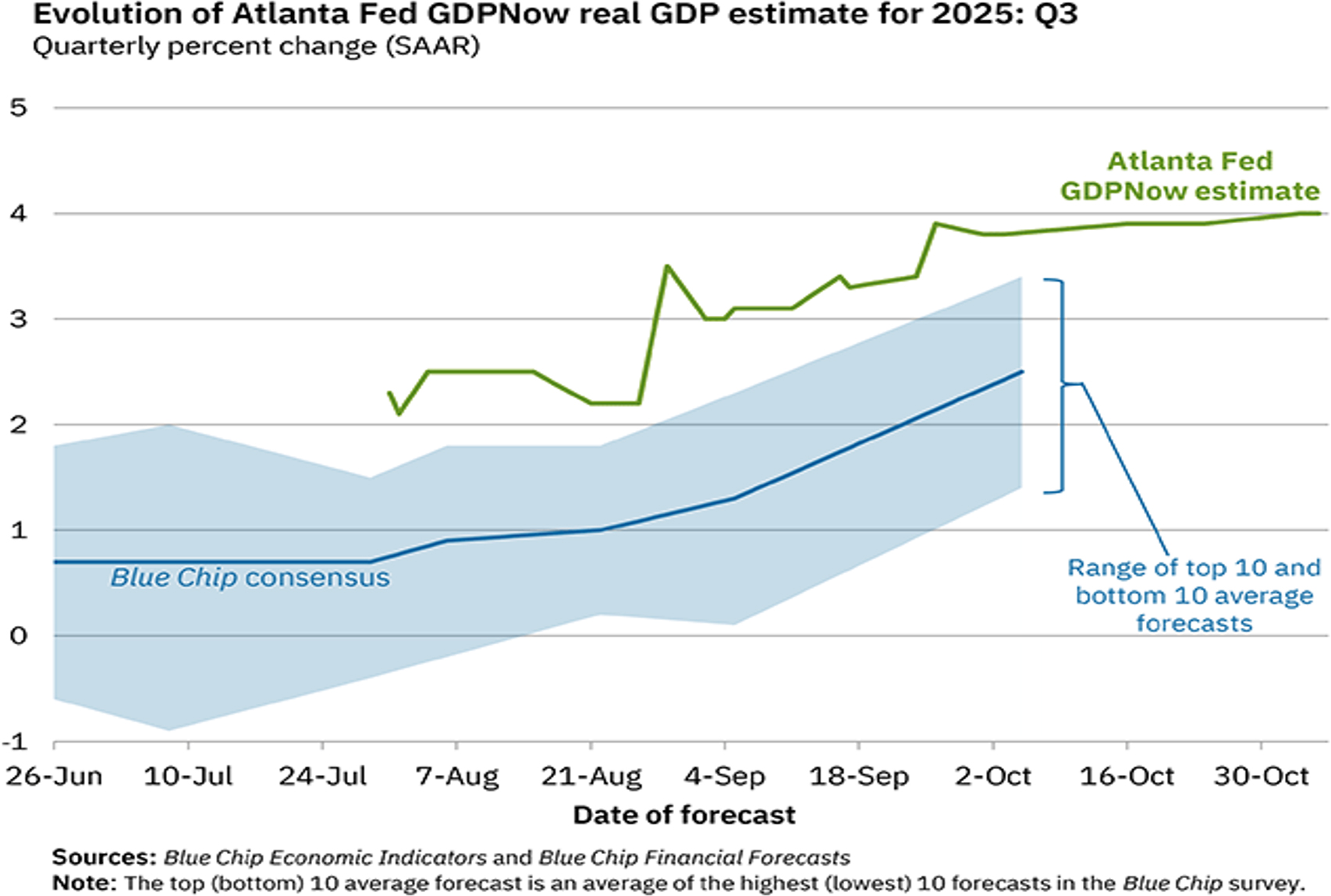

We also need to note, however, what hasn’t taken place in the past seven months. Clearly, the US hasn’t entered a recession. Economists were united in the view that the administration’s high tariffs would tip the US and global economies into contraction. While we currently don’t have economic data being released (thank you, government shutdown!), the Atlanta Federal Reserve maintains an online, real-time tracker of projected GDP. Their efforts have proven more accurate than the economic consensus. As shown in the chart below, the third-quarter GDP is forecast to grow at a 4% rate.

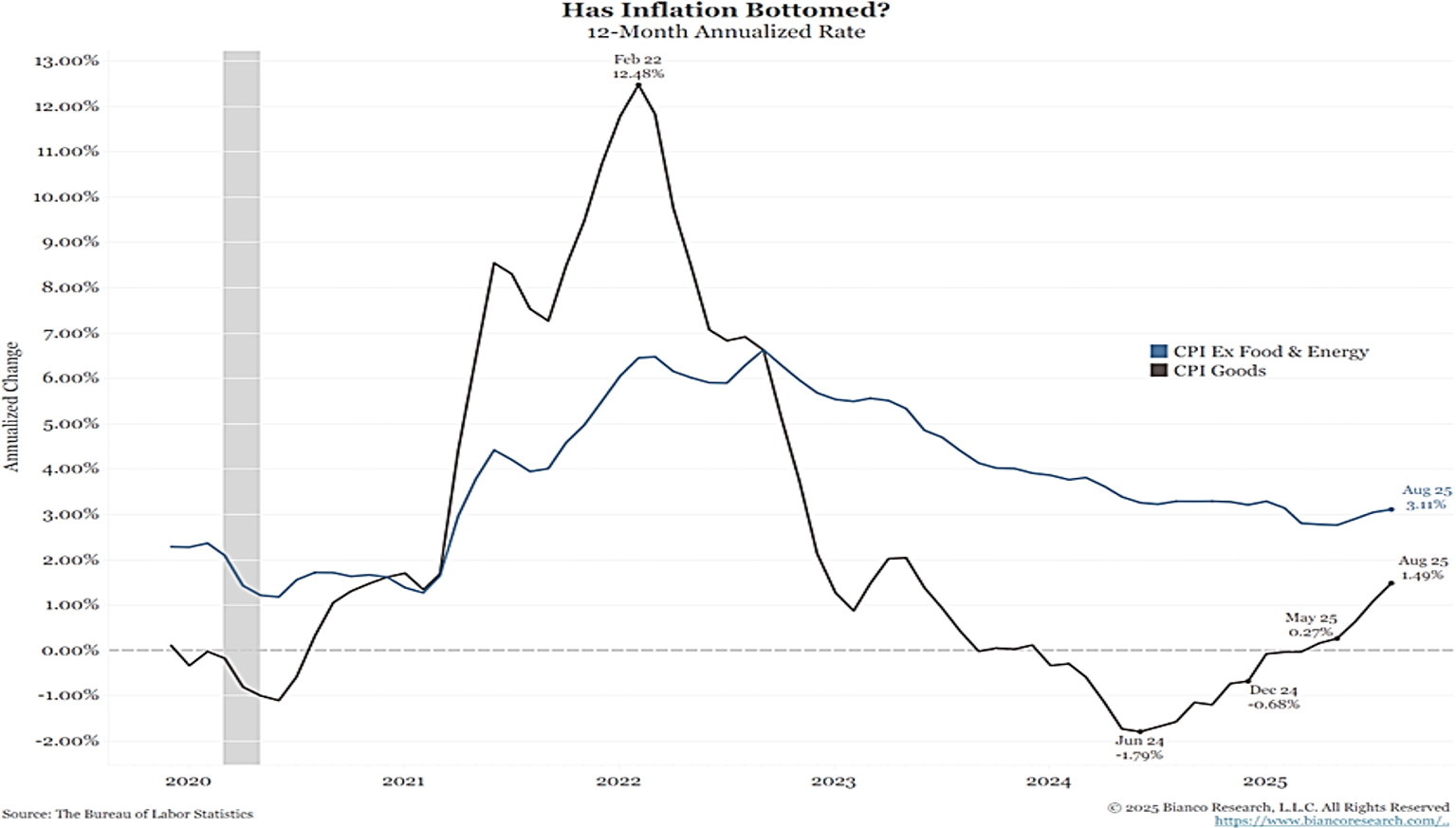

In addition to the economy not crashing, and even accelerating in its growth, inflation hasn’t run away. We have more to say about inflation below, but it hasn’t spiked as much as feared:

We are concerned about the trend in inflation. If the economy is accelerating and the labor market is tight due to changes in immigration, the uptick in core inflation in the graph above may be a taste of what is to come in 2026. Financial markets and the Federal Reserve aren’t prepared for that development.

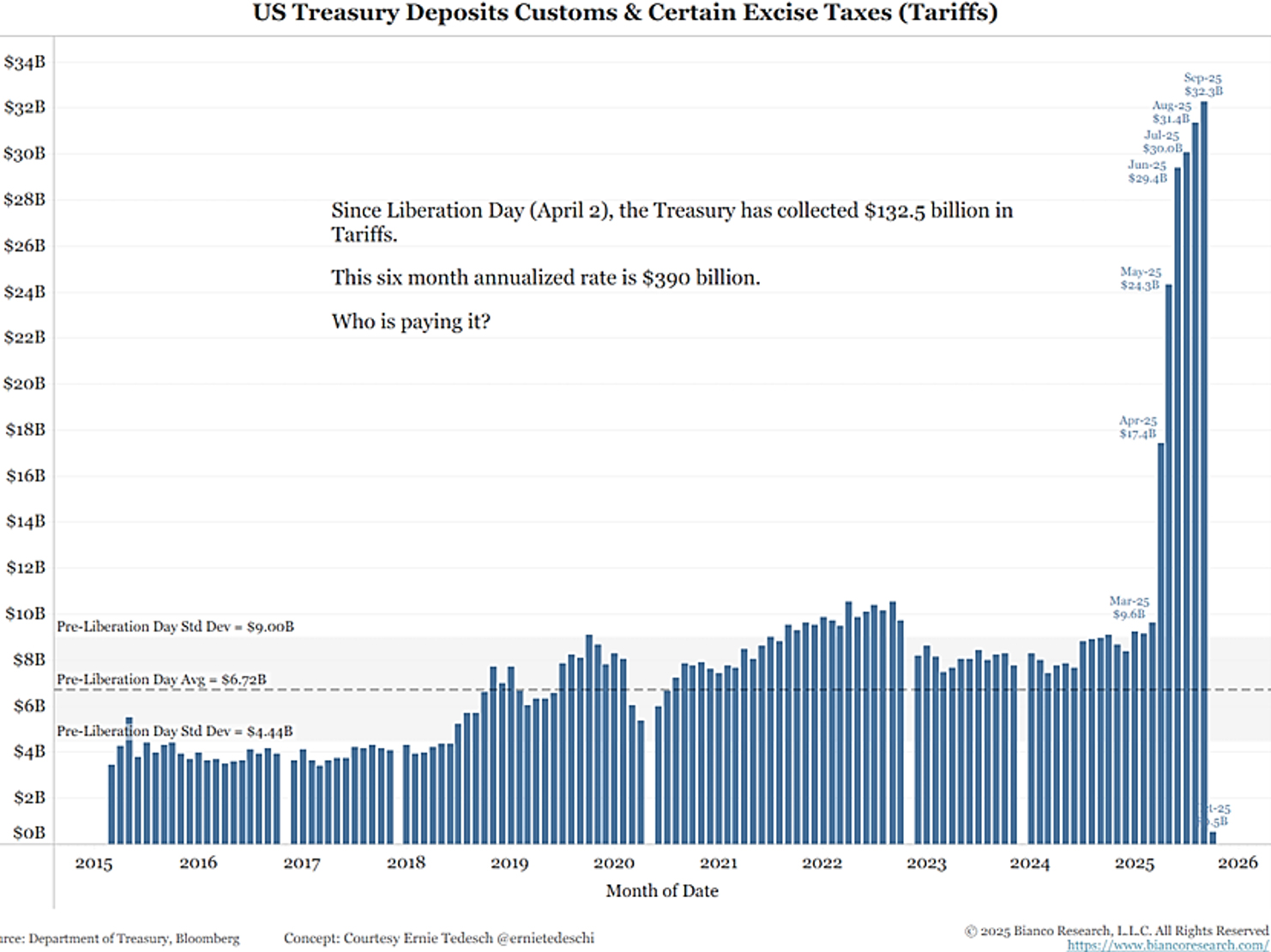

Any discussion of tariffs wouldn’t be complete without an observation about the revenue being generated. Through August, the annualized tariff revenue has been noteworthy:

If the nearly $400 billion pace is maintained, these revenues would reduce the US budget deficit by nearly 20%. We have long complained that the US has an unsustainable deficit problem, but the political will to reduce spending or increase taxes doesn’t exist. Viewed through that lens, the “tax” of tariffs may be keeping deficits lower than they otherwise would be, while being paid, at least in part, by foreigners. While we would still prefer political courage, political expediency appears to have prevailed. If the net effect is a meaningful reduction in the budget deficit, we should take the win.

Where are interest rates headed?

While the Federal Reserve can set short-term interest rates, longer-term rates are determined in the market. Longer-term rates are influenced by Fed policy at the short end, but expectations for growth and inflation are key factors in determining the level of longer-term rates.

One year ago, when the Fed cut short-term rates by 50 basis points, the long end of the bond market reacted very negatively as long rates, including mortgages, shot higher. Investors were fearful that the Fed was making a mistake and stoking inflation.

When the Fed cut rates in mid-September, we were concerned about a similar reaction. After all, an economy with inflation near 3%, unemployment at just over 4%, GDP growth at nearly 4% and a stock market making all-time highs doesn’t sound like an economy in need of stimulus. But stimulus we got, along with modestly lower rates. The Fed is reacting to signs that the job market is slowing. We believe immigration changes have misled the Fed, and we worry that inflationary pressures will intensify in the coming months.

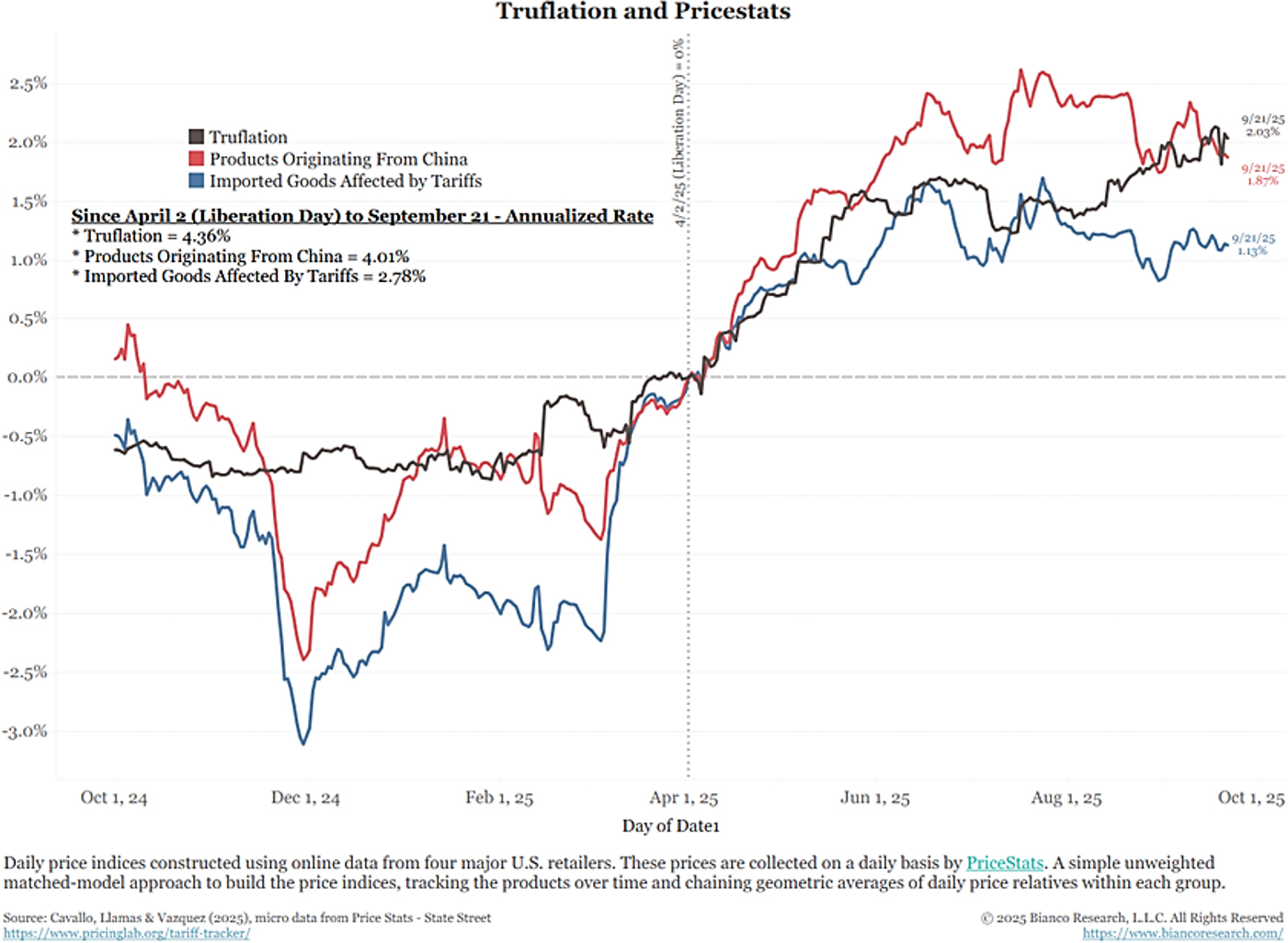

An earlier graph highlighted that core inflation and goods inflation have both begun to rise. Some alternative measures of inflation offer even more reason for concern. Pricestats collects a real-time database of prices from major retailers. Their analysis of inflation across all products, particularly those coming from China and other nations subject to tariffs, is alarming:

If the market concludes that the Fed is making a policy mistake in cutting rates, we think bonds of longer duration will suffer. We prefer to focus on higher-quality, floating-rate bonds and senior loans backed by strong collateral.

The AI Boom

Since the rollout of ChatGPT three years ago, artificial intelligence (AI) and its “investability” have dominated the global markets. JP Morgan has estimated that AI-related stocks have accounted for 75% of market returns, 80% of earnings growth, and 90% of all of the capital spending in the US. The numbers are truly mind-boggling in terms of what is being deployed to build data centers and train AI models.

For investors, the ultimate question is whether sufficient revenue will be generated from AI to provide an adequate return on investment. Only time will tell, but the numbers are numbing. When you are spending over $1 trillion on data centers, you will need more than the $12 billion that is estimated to be spent on AI services in 2025 to have adequate return on investment. Count us as skeptical on this one.

We are also concerned about the increasingly complex financial arrangements being employed in the AI space today. Recently, OpenAI (ChatGPT) received a $100 billion investment commitment from Nvidia. OpenAI, in turn, promised to buy $100 billion in chips from NVDA. Oracle got into the game with an announcement of $60 billion in orders from OpenAI. The problem is that OpenAI doesn’t have the money. Michael Cembalest from JP Morgan summed it up well:

Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google.

What could go wrong? More than we can detail here. Our point is not that anything illicit is taking place. Instead, we would note that this smacks of the type of activity we saw during the dot-com bubble. We built way too much fiber optic capacity way too soon. Eventually (i.e., think twenty years), we needed it all, and the internet was even more revolutionary than anyone could have dreamed. During that twenty-year period, however, investors who financed the boom suffered. We continue to work to strike the balance between enjoying the boom in AI names but remaining well diversified to protect our downside risk.

The Stock Market Outlook – Momentum vs. Value

The outlook for equities really comes down to a contest between momentum and value.

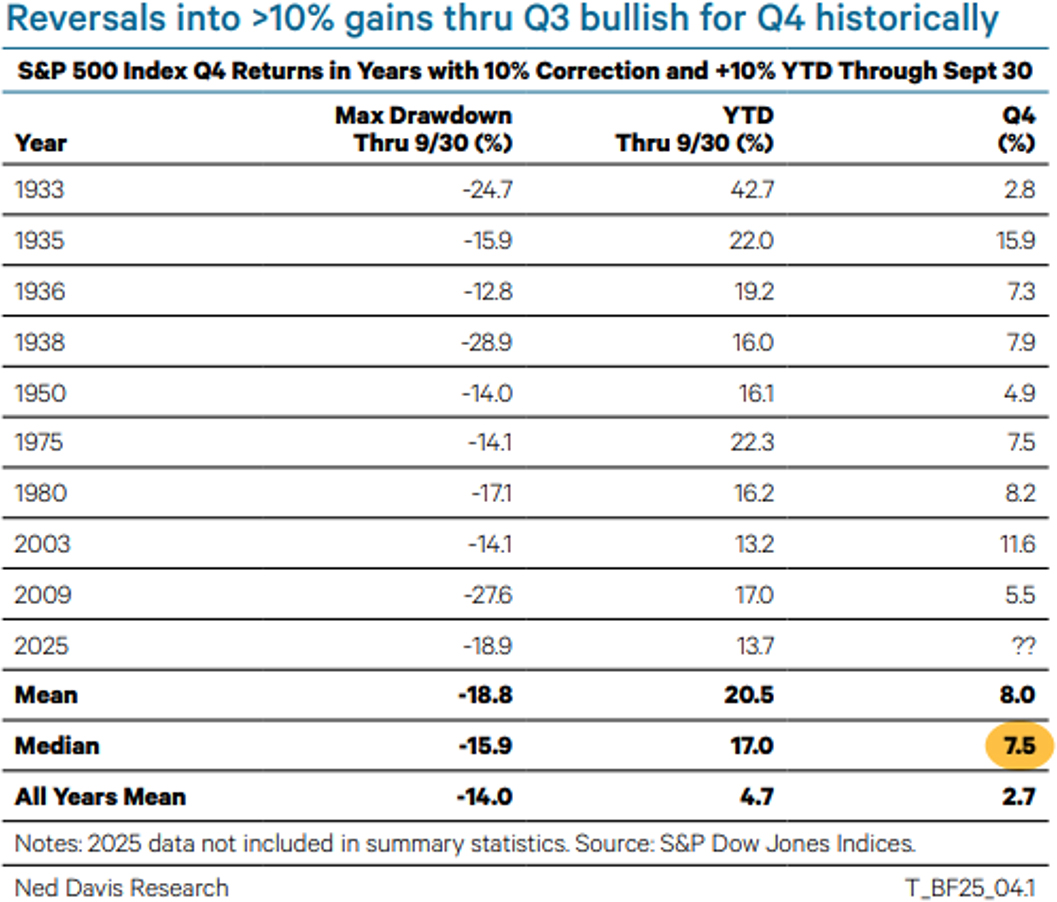

Currently, equities are reaching all-time highs against a backdrop of a growing economy and lower global interest rates. When you couple that with the strong rebound off the spring lows, the outlook is impressive. In the prior cases where equities had a 10% correction and were still up 10% by the end of September, the market has rallied in the fourth quarter every time, with median gains of 7.5%.

History may not repeat, but it does rhyme, and the data from Ned Davis highlights the power of this momentum:

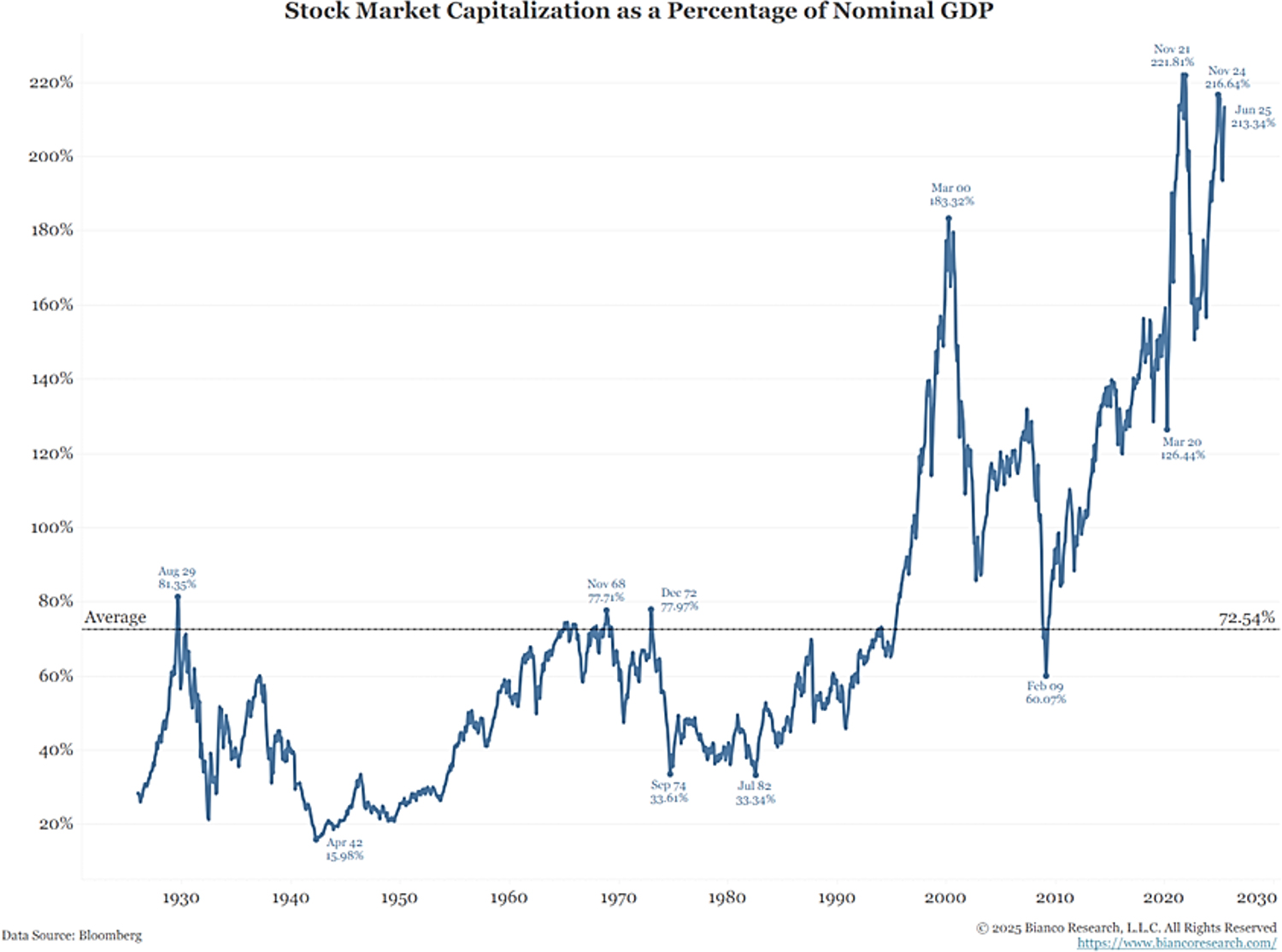

Given this history, why wouldn’t an investor go all in? The simple answer is that stocks are, by any measure, somewhere between fully valued and very expensive. Warren Buffett’s favorite stock market indicator, comparing total stock market values to GDP, shows that there have been few times in history when stocks haven’t been pricier:

Is this a bubble? We don’t know, and we won’t know until it is over. Regardless, “it” can likely continue for longer than anyone can imagine. We plan to invest with an eye toward broad diversification with a clear view of liquidity needs while avoiding the most recklessly speculative fads so that we can enjoy the ride (however long it lasts) and fight another day.

Summary

It was an excellent quarter for all markets. We rarely see all assets firing simultaneously. While this is enjoyable while it lasts, we know it cannot continue forever. Being value-conscious and risk-averse, we will continue to emphasize the importance of discipline, patience, and diversification in asset management.

As year-end approaches, we will also attend to time-sensitive tasks, particularly those related to tax matters. If you have any thoughts, questions, or concerns, share them with us.