After a brutal month of June capped a terrible quarter in what has been a terrible year to date for investors, the markets finally offered a respite in July. Stocks posted their best returns since “vaccine” month in November of 2020.

Investors hope that the equity markets visit to bear market territory (i.e., declines of 20%) was brief. The equity market rebound was fueled by a decline in interest rates. Because bond prices move inversely to interest rates, even the moribund bond market offered positive returns. International events continue to conspire as the war in Ukraine and China’s ongoing commitment to “zero Covid” strains already frail global supply chains.

The painful stock market decline has largely reflected the impact of higher interest rates on price earnings ratios. All other things being equal, higher rates result in lower PE multiples and thus far in 2022, we have seen multiples contract from 22 to 15. If a recession is avoided, it is likely that most of the pain of this downturn is over. If the battle against inflation, which was started too late and with too little commitment by the Federal Reserve, must continue, a recession may be the result. In a recession, corporate earnings fall and that may put further pressure on stock prices. We will learn more in the coming weeks as second quarter earnings are released and companies offer second half guidance.

A look at the Second Quarter and the First Half of the Year

Mom often reminded us that if you don’t have something nice to say, you shouldn’t say anything at all. We don’t have anything nice to say about market results for the year to date but we can’t hide from reality. There simply wasn’t any place to shelter in the second quarter.

The short version of events was summarized by Rabobank’s Michael Every who noted that “if you bought stocks in H1, you lost; if bonds, you lost; if commodities, you were doing great until recently; if crypto you lost; if the US dollar, you were fine” but lost purchasing power to inflation, the first six months of the year was terrible.

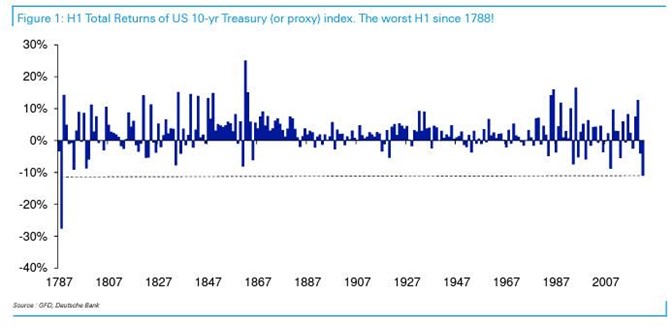

How bad was it? For fixed income investors, the US 10 year Treasury is the benchmark standard. Although Treasuries that we know today weren’t being issued in 1788, Deutsche Bank has created a proxy index. As can see below, returns in the first half were the worst since 1788!

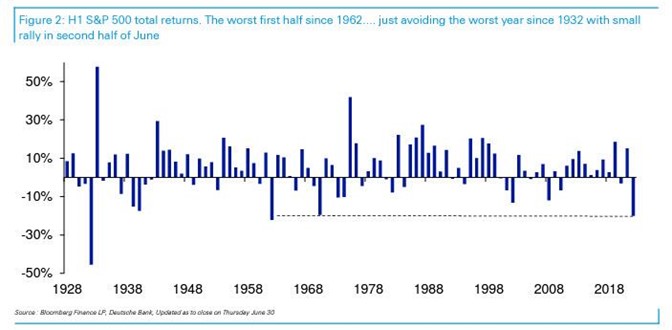

Equity market returns were also dreadful. This included foreign and domestic stocks, large and small. While value outpaced growth, it did so be losing less. To put it in perspective, only a modest rally in the last week of June kept S&P 500 returns from being the worst since the Great Depression:

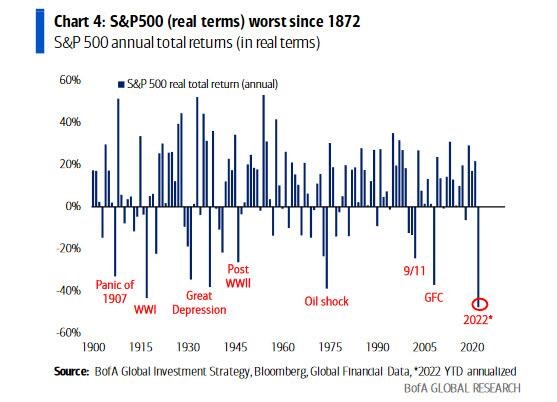

The driver of the stock and bond market weakness has been inflation, with food and energy spiking most painfully. The conditions for an extended period of rising and accelerating inflation were actually put in place over the past fourteen years. Covid, the resulting lockdowns, and the enormous policy response by the Federal Reserve and the Federal government’s bacchanal spending were the straws that broke the camel’s back. The war in Ukraine is only making matters worse as disruptions to global energy markets and grain markets are beginning to ripple across the globe. When we account for inflation (by looking at “real returns”, or those earned after inflation, S&P 500 results were the worst since 1872:

The sharp rise in inflation pressures has forced the Fed into an uncomfortable and unfamiliar position. Ever since the Great Financial Crisis, the Fed has chosen between more or less stimulus. Sometimes the stimulus took the form of lower rates, but rates couldn’t fall below zero, the stimulus morphed to asset purchases (i.e., quantitative easing). The latter is what grew the Fed’s balance sheet by 10 times (i.e., $8 trillion) between the fall of 2008 and today. A lack of inflation allowed the Fed the luxury of providing this stimulus. Now, however, inflation has put an end to that game. The Fed has finally started to withdraw stimulus by simultaneously raising interest rates (although at an embarrassingly modest pace) and by allowing the balance sheet to shrink (i.e., quantitative tightening).

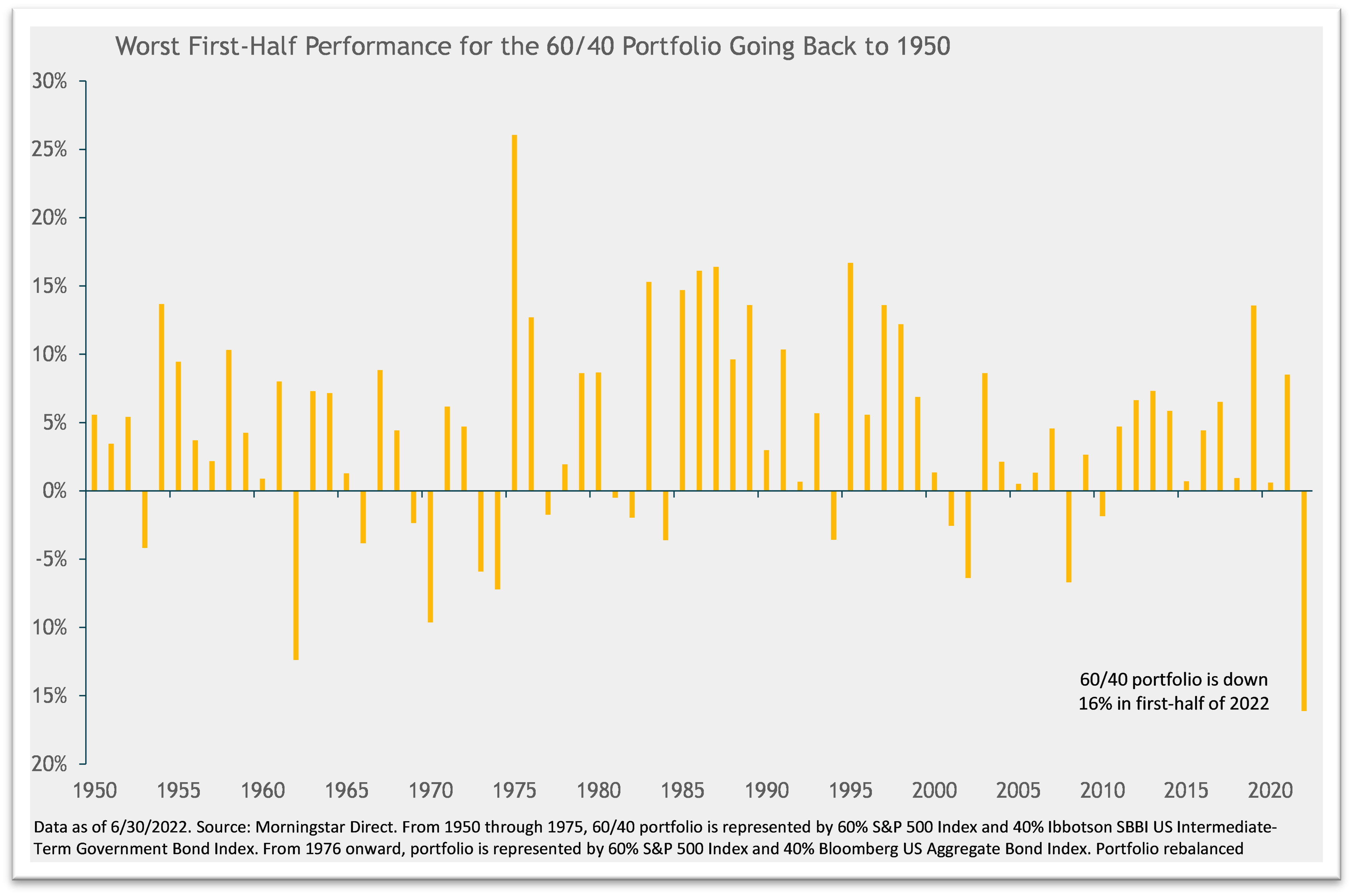

The result is that, when all of the building blocks of a portfolio are struggling, the notion of mitigating risk with a diversified mix of assets is sorely tested. The benchmark portfolio of 60% stocks and 40% bonds as long represented the standard starting for evaluating a portfolio by fiduciaries. This traditional asset mix suffered its worst first half performance since 1950:

In an environment like this, cash returns were just .36% as interest rates started the year at such low levels. While it is nice to see a return without a minus in front of it, the fact is that inflation ravaged the purchasing power of that modest return.

So Where Do We Go From Here?

We believe that the battle to control inflation with higher interest rates is and will continue to be the dominant issue for the markets as we move forward. There are always lots of important issue for investors to consider. Right now, we would cite the following as potential stress points:

- The lingering battle with Covid (see China’s harsh lockdowns)

- The war in Ukraine

- The strength of the US and global economies (market performance is far worse in a recession as opposed to a slowdown)

- Upcoming US elections and resulting policy uncertainty

For investors, none of these issues can transcend inflation and rising interest rates being used to battle inflation. With few interruptions, the fact is that interest rates have declined for nearly 40 years. In the fall of 1981, when investors could buy 30-year, non-callable US Treasury bonds at 15.75% yields to maturity, no one wanted them. Today, we look back and ask “What were they thinking? How could anyone pass up that opportunity?” The answer is that after a decade of bruising inflation, most investors couldn’t see how inflation and interest rates could fall. We suspect that, years in the future, our children and grandchildren will study late 2021 and wonder at how investors could buy 30-year, non-callable US Treasury bonds at 2% yields when inflation was running at 8%. Who would willingly lock in negative real returns? Once again, a failure of imagination has blinded investors to the possibility that central bankers who have wanted higher inflation may get their wish. If higher inflation begets higher interest rates, so be it. Stock price levels are no longer a central focus on the Fed.

This is ultimately a very healthy development. The Fed shouldn’t fixate on nor manipulate stock prices. Stock prices are not, after all, the economy. The transition, however, from a heavily dependent market to a market free of that dependency has the potential to be volatile and, at times, painful. In much the way that a substance abuser needs to go through a painful process of withdrawal to reach a better, healthier state, so must the markets wean themselves from artificial stimulus. The difficult first five months of 2022 seem a likely preview of what investors may be faced with as the Fed does battle with inflation.

If our concerns about the difficulty of taming inflation are correct, both stock and bond markets are likely to remain volatile. While diversification and a suitable time horizon always remain the preferred methods to deal with market volatility, this paradigm shift toward higher rates dictates a shift in portfolio emphasis.

When interest rates are at the “zero bound,”, capital is essentially free. When capital is free, the rigor with which businesses and investors allocate their capital diminishes. In the public securities markets, this manifests itself in risk taking. Fixed income investors move from high-quality, short-term securities to long dated speculative bonds. In the equity markets, solid business with resilient balance sheets aren’t nearly as sexy as companies that promise to grow to the sky even though they have no hope of ever making a profit. The party is great fun until the music stops and the reversal of interest rates is the clearest sign that the party is over.

For fixed income investors, cash returns have suddenly moved up and become a compelling alternative to bonds. We think that Treasury bills, with the highest credit quality and liquidity, are of greatest interest. Bond investors always have to balance credit risk and interest rate risk, but at the moment we think the latter is a bigger issue than the former If rates rise too far too fast, the Fed may trigger a recession. This means that high-quality, short-term bonds (with less rate risk) or floating rate instruments make the most sense. We are also partial to alternative strategies that can offer what we hope to get from bonds (i.e., lower volatility and uncorrelated returns) without the interest rate risk.

In the equity markets, fundamentals are re-asserting themselves. They always do, but the last few years have been a painfully long stretch where hopes and dreams trumped discipline and insight. As fundamentals move to the fore, we think strong businesses with sound balance sheets will supplant the high growth, speculative names that led the market higher. Investment strategists describe this as “shortening the duration of your equities.” This is an excessively complicated way of describing what we call being “closer” to your cash flow.

By way of illustration, consider two alternative real estate investment opportunities. The first is with a developer with big dreams. He plans to close on land he has under contract, using debt to make the purchase. Once that is closed, the plan is to complete the design of a new “multiuse” property. After plans are finished and permits secured, a bank will be engaged to provide construction financing. A builder will work on the project but in a high inflation environment, the builder will work hard to shift the risk of rising material costs to the developer and his investors. Once construction is complete, permanent mortgage debt will replace the floating rate construction loan, but at whatever market rates prevail. Since this will be a few years down the road, early investors will comfort themselves with rosy forecasts about a rapid pace of leasing at very attractive rates. A few years after the project is leased, investors hope to begin to see some modest cash flow. A few years after that, it is projected that the project will be sold at a large profit to an otherwise sophisticated (though unidentified) buyer. For the investor considering this “opportunity”, the list of potential problems is nearly endless. We would distill those down to the fact that you are “far” from your cash flows. Even if everything goes according to plan (and it never does), an investor won’t get paid for some time.

Contrast this hypothetical, high return (but long duration) investment with an alternative. Perhaps that alternative is a high quality, fully occupied apartment or warehouse project. The project in question can be purchased at a price that will yield an immediate, though lower than desired, cash return. Over the years, if rents grow and management is successful in their efforts, the property may be kept or disposed of. In either cash, it is easy to see that at nearly every juncture, this opportunity has less risk. Instead of guessing at construction costs, a buyer can inspect the property and make much more accurate assessments of maintenance costs. Rather than guessing at what rate permanent financing might replace a construction loan, a buyer can lock in costs in predictable fashion. Speculation about lease rates and pace can be more informed by seeing what actual leasing history and rates are.

Given the uncertainties of the current environment, we think the second hypothetical is more attractive in our brave new world of rising rates. Focusing on quality and cash flow doesn’t mean that any investment is immune to fluctuations in price or the vagaries of the market, but we are confident that holdings with those qualities can offer more stability and a higher chance of success in a more difficult operating environment.

Investments with these qualities have long been our focus as we didn’t believe in the new era thinking that drove the speculative excess now being unwound. Seeking these types of holdings remains our central focus for portfolios today. Often this is expressed in the negative (i.e., it is sometimes easier to know what we want to avoid) but what you don’t hold can be as important as what you do hold. Of greatest importance, however, is to note that the urge to “do something” isn’t always a temptation that you should succumb to. As your advisor, our role is to develop and maintain a plan. The plan must adapt to changing conditions, but adaptation is always a more subtle and gradual process that resists violent reactions. Rarely have we seen portfolios that lurch to extremes produce satisfactory results.

We leave you with a final observation from one of our favorite writers and commentators, Jim Grant. In a recent speech, he observed that “. . . money is not humanity’s best subject. The story of investing is the story of people coping, or trying to cope, through cycles. They – rather, we – overdo it on the upside only to underdo it on the downsize. We are bullish at the top and bearish at the bottom, and we have so conducted ourselves under the gold standard, the gold-exchange standard, the Bretton Woods variant on the gold exchange standard and, for all I know, the Babylonian barley-cum-silver standard. It’s hardly surprising that we are doing no better today . . . wrong rates lead to wrong decisions.”

As we move away from “wrong rates” to a normal environment, we will continue to guide you on the journey. As always, we welcome your comments and questions and are grateful for your trust and confidence in the face of turbulence and uncertainty.