Many questions arise after you graduate and are introduced to the working world. Questions such as: How much can I spend? How much should I save? Where should I save? While these initial questions might seem complicated, there are a few general guidelines that will set you on a path for long term success.

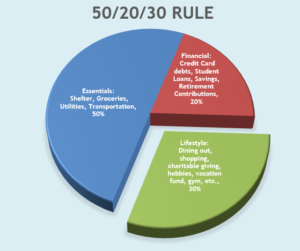

To begin, a good general budgeting rule to follow is the 50/20/30 rule. This is where you break down your take-home pay check into 3 categories (Essentials, Lifestyle, Savings) and try to keep them within the given percentages.

- 50% Essentials: Rent/Mortgage, Food (not restaurants), Utilities, Gas/Car Payments, etc.

- 20% Savings: Student Loans, Retirement contributions, other savings

- 30% Lifestyle: Restaurants, Traveling, Subscriptions, etc.

The essentials and lifestyle categories can be easier to define because they should be fun, desired and/or needed. All of your essential spending helps to build your independence. While, choosing which ski pass to buy, how to spend your vacation, where to eat-out, or all of the above are fun and enjoyable ways to learn how to manage your spending. These are also typically expenses that are accumulated on a credit card, which can give you added benefits or cause headaches if you aren’t careful. It is important to pay off that credit card on a monthly basis and track the expenses to make sure you follow the 50/20/30 rule. (future credit card blog to come)

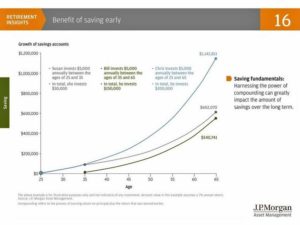

The savings category is where it can be more cumbersome. Although it may be more of a burden, saving is what allows you to take that extravagant vacation and ultimately guide you towards a stable retirement. You might even be tempted to skip this 20% ‘for now’ and enjoy more of the lifestyle activities, after all retirement is far in the future. However, the sooner you start to save (no matter how small that 20% may seem) the more time you have to let it grow. The power of compounded growth is unbeatable!

So, let’s break down the savings and how you should allocate that 20%. Again, there are a few generalizations that can make the process a little easier.

To start, there’s the rainy-day fund. Typically, it’s about 3-6 months of expenses that are kept in a savings account. Preferably one with a higher interest rate. From there start moving down the following categories.

- Student Loans – These can have very high interest rates and so are advantageous to pay down quickly. Make sure to allocate enough to pay a little more than the monthly minimum each month.

- Additional Debt – Credit card debit also typically has very high interest and can become a large burden if left unpaid. It is important to pay off any credit card debt as quickly as possible, and refrain from amassing any.

- Company traditional 401k – This is typically a tax deferred vehicle that you should not expect to have access to before age 59.5. Always make sure to contribute enough to your 401(k) to take advantage of an employer matching policy. This is one of those rare instances where you can get free money!

- ROTH 401k – Some companies offer ROTH 401(k)s as well as traditional 401(k)s. The difference here is that contributions are taxable but the growth and distributions in the future are tax free. For a traditional 401k, contributions are not taxable, the growth is tax differed as your distributions will be taxable. If your income is lower (meaning you are in a lower tax bracket), and the same company match is offered to both a ROTH and traditional 401k consider contributing to a ROTH 401k instead of the traditional 401(k).

- ROTH IRA – If you still have money to save, you aren’t contributing to a ROTH 401(k), and your AGI is below $124,000 single, $196,000 joint consider saving to a ROTH IRA. Contributions to a ROTH are taxable but the growth and distributions are tax free. The earlier contributes are made to a ROTH the longer time you have to let it grow maximizing your tax benefits. Note, you can take out contributions at any time but it is not something that is advisable. The growth cannot be withdrawn until you are 59.5. For 2021 the max contribution is $6,000.

- HSA contributions – If you are part of a high deductible health plan you can contribute to an HSA. Originally an HSA was designed to help pay for unforeseen medical expenses. However, this vehicle is extra special as the contributions are tax free, growth is tax free and distributions can be tax free (more on that to come). Because of its ability to be triple tax free it is a great vehicle to contribute to on a yearly basis. For 2021, the max contribution is $3,600 for an individual, $7,100 for a family.

- Brokerage accounts – This is a great place to invest additional savings that can eventually be used for major goals or vacations.

It’s hard to allocate funds to every bucket especially when starting out. It’s good to add funds to multiple different buckets if possible but which ones are best is highly dependent on an individuals situation, which is where an advisor can help. What’s most important is to try and build a budget for yourself as outlined and keep to it. As your income grows continue to try and follow the 50/30/20 rule, growing your savings as well as your spending.